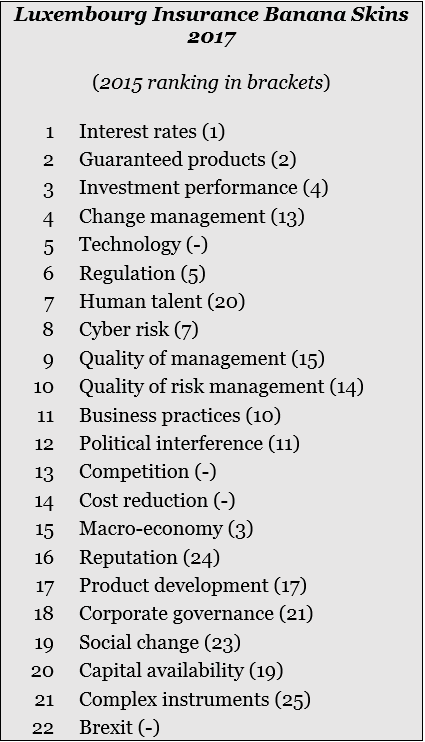

The persistence of low interest rates, guaranteed products and investment performance, combined with the industry’s ability to confront structural and technological changes are the top banana skins for the insurers in Luxembourg.

A new PwC – CSFI (Centre for the Study of Financial Innovation) survey charting the top risks in the global insurance sector highlighted that players worry about the low level of interest rates, and its associated effect on investment returns, solvency and products with guaranteed rates of return.

Concern was also higher than the global average about the quality of management in insurance companies, and its ability to cope with the pressures facing the industry from new technology and new forms of competition. As elsewhere, many respondents mentioned the risks from excessive regulation which one of them described as being written “by academics and civil servants”.

The report also raises concerns about the industry’s ability to address the formidable agenda of digitisation, with change management and technology jumping high in the top of rankings. By contrast with other countries, cyber threats were not placed among the very highest risks and there was also relatively less focus on the outlook for the macro-economy

Notable differences between the Luxembourg and the global responses included guaranteed products, quality of management, quality of risk management and corporate governance as higher concerns, while change management, competition and cyber risk were lower.

The ‘Insurance Banana Skins 2017’ survey is available on PwC Luxembourg website.