Anyone watching today’s European insurance market sees one thing: consolidation is no longer optional – it’s survival. The strategic urge for scale, the need to manage legacy books more efficiently, and investors’ appetite for predictable, long‑duration cash flows are all pushing deal activity higher. In this evolving landscape, actuaries are moving beyond their traditional role of “reserve checkers”. They are becoming true strategic partners – driving value creation by shaping deal pricing, sharpening risk assessment, optimising capital and contributing to smoother post‑merger integration.

In this blog, we explore how actuarial insights support every stage of the transaction, and how they ultimately influence whether a deal creates value or destroys it.

European insurance M&A outlook – and why it matters now

M&A activity across Europe’s life, health, and P&C carriers has remained steady. Buyers are still drawn to attractive asset pools, in-house asset management opportunities, cost and capital synergies, and the broader consolidation trends. At the same time, shifts in macroeconomic and regulatory forces – such as inflation, interest rate movements, credit market dynamics and recent Solvency II reforms – continue to influence how investors think about value and risk.

We are increasingly seeing small and mid‑sized insurers, who are already struggling with margin pressure, rising costs or years of tech under‑investment, become natural targets for consolidators. Many of the deals last year were liquidity driven, essentially the low‑hanging fruit: simpler to execute and reasonably priced. But the real test of value creation doesn’t happen at signing; it happens after the deal closes. The difference between a value-creative and a value‑destructive acquisition ultimately lies in how effectively the buyer manages the books and capital with discipline post‑consolidation.

As we move in 2026, we expect a renewed wave of M&A activities. Softening P&C pricing is pushing carriers to look for growth beyond rate‑driven earnings, and history shows that these moments often open the door to more dealmaking. Surplus capital across many European composites adds fuel to the momentum, with carriers likely to redeploy it into bolt‑on acquisitions, capability buys and diversification. Recent deals already point in this direction, such as AXA’s investment in Prima to strengthen direct distribution and Munich Re/ERGO’s full acquisition of NEXT Insurance to deepen digital SME underwriting capabilities.

Across Europe, insurance M&A activity remains concentrated in a handful of highly attractive markets, notably France, Germany, Italy, and Spain, each offering distinct opportunities for buyers. At the same time, the UK also remained one of the most active markets due to ongoing portfolio simplification and consolidation especially in the Bulk Purchase Annuity (BPA) space.

Within this landscape, Luxembourg is emerging as an increasingly compelling market. For its size, it remains remarkably influential with its cross‑border model, regulatory stability, and strong appeal among international and high‑net‑worth clients. These factors give it a strategic profile many larger markets can’t match. As a results, it remains a strategic location for carriers seeking capital‑light growth, portfolio rebalancing, and opportunities aligned with Europe’s broader shift toward long‑term savings and cross‑border platforms.

Recent European deals at a glance (2023-2025)

| Year | Buyer | Seller / Target | Deal Value | Segment |

|---|---|---|---|---|

| 2025 (announced) |

Athora Holding | Pension Insurance Corporation (PIC) | £5,700m (~€6,580m) | Life & Pensions (Bulk Annuities) |

| 2025 | Aviva | Direct Line Insurance | £3,600m (~€4,200m) | P&C (Retail, Motor, Home) |

| 2023 | Aviva | AIG UK Protection | £460m (~€530m) | Life |

| 2025 | AXA | Prima Assicurazioni (Italy) – 51% | €500m | P&C (Motor) |

| 2024 | Unipol Gruppo | UnipolSai stake consolidation | €1,210m | Life / Composite |

| 2025 | Consortium (Allianz, BlackRock, Generali and T&D) | Viridium Group | €3,500m | Life (Consolidator) |

| 2024 | BNP Paribas Cardif | Neuflize Vie (AXA stake) | Not disclosed | Life |

| 2023 | Consortium (SMABTP and MACSF) | CCR Re | Not disclosed | Reinsurance |

| 2024 | Monument RE | Integrale | Not disclosed | Life |

| 2023 | Generali | Liberty Mutual Spain | €2,300m | Life & Non-Life |

| 2023 | Ageas | AG Insurance 25% stake (BNP Paribas Fortis) | €1,900m | Life |

Sources: PwC analysis, Sector Reports and Public Filings.

Actuaries as strategic partners in transactions

Actuaries sit at the centre of insurance M&A because they understand how underwriting risks, claims behaviour, pricing discipline, capital requirements, and asset‑liability interactions combine to shape economic value. In diligence, this perspective helps buyers answer the fundamental questions that determine deal viability: are earnings sustainable under realistic assumptions; where does the valuation bend under stress; which risks are structural versus what can be mitigated; and how much volatility or capital strain can be removed post‑deal? By addressing these, actuaries help buyers move from risk detection to value creation.

How transactions are priced

Pricing in insurance M&A typically relies on two complementary approaches: fundamental valuation and market-based valuation. Each provides a different lens for assessing deal value and risk. Together, they form the basis of a defensible purchase price.

Fundamental (intrinsic) valuation – appraisal value

Fundamental valuation is typically based on an actuarial appraisal model – effectively a Dividend Discount Model (DDM), or a Discounted Cash Flow (DCF) of future after‑tax distributable earnings. These earnings represent the cash that can be released to shareholders after meeting regulatory capital requirements and are discounted at the buyer’s cost of capital or target Internal Rate of Return (IRR) to determine the target’s intrinsic value.

Several valuation scenarios are typically developed and assessed reflecting difference between buyer/seller respective objectives and their views on risk and upside. Actuarial input is critical, as each scenario reflects different assumptions and findings arising from due diligence:

- Seller case (Base Case): Based on the seller’s actuarial cash flows, experience data and business plan;

- Buyer case: Adjusted for the buyer’s revised assumptions and insights from actuarial and financial due diligence;

- Upside case: Includes expected synergies, capital optimisation opportunities, and performance improvements; and

- Downside case: Captures potential adverse developments such as assumption weakening, model risk, or execution challenges.

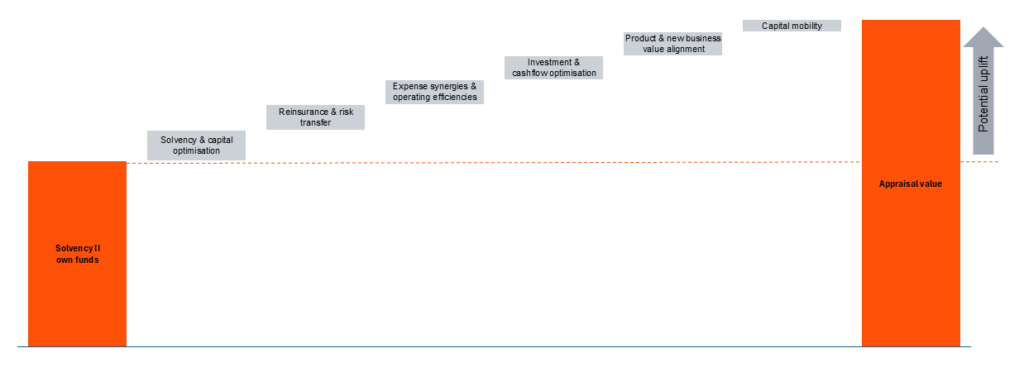

Appraisal value bridge

A simple way to see the economics is the appraisal value “bridge,” which adds three building blocks: today’s Adjusted Net Asset Value (ANAV) or surplus; the value embedded in the existing book (VIF, value of in‑force); and the franchise value of tomorrow’s sales (VNB, value of new business).

Appraisal Value = ANAV + VIF + VNB

This valuation bridge helps both parties see how sensitive transaction value is to the underlying actuarial drivers and where the real economic substance lies. It clarifies the balance between value generated from the run‑off of the in‑force book versus the value expected from future new business, and it highlights how much of the price reflects tangible, measurable economics as opposed to synergy‑ or growth‑dependent upside. This level of transparency is precisely why actuarial appraisal remains the cornerstone of insurance M&A.

Market-based valuation

Market-based valuation benchmarks the target against relevant market indicators to validate and contextualise the fundamental valuation.

Trading multiples of listed peers offer insight into investor expectations:

- Dividend yield and cash generation yield indicate income relative to price and the sustainability of shareholder distributions; and

- Price to Unrestricted Tier 1 (P/UT1) own funds compares the deal price to the insurer’s highest-quality regulatory capital. UT1 is often adjusted to exclude transitional measures, intangible assets, and other items not attributable to shareholders to provide a more economic view. This metric is similar to price-to-book but tailored for insurance regulation.

Transaction multiples from comparable acquisitions add real‑world pricing evidence, reflecting strategic premiums, competitive tension, and the buyer’s synergy expectations.

While market benchmarks add valuable external context, they do not replace the need for a rigorous actuarial view. Buyers ultimately adjust projected cash flows for assumptions, risks, and findings identified during due diligence. This ensures the final valuation reflects both market realities and the specific risk profile of the target – reinforcing the critical importance of actuarial expertise in arriving at a fair, defensible deal price.

Why similar deals are priced differently

Even when two insurers look comparable, prices can diverge significantly. Capital fungibility, dividend capacity, regulatory friction, and new‑business sustainability all influence return on capital. Buyers also evaluate how much downside the business can absorb without breaching hurdle rates. As a result, seemingly comparable deals can clear at very different multiples – because the underlying ability to generate, release, and protect value is not the same.

Maximising value: where deal pricing meets real‑world value creation

Understanding what a business is worth is only half the story in insurance M&A. The other half – and often where buyers differentiate themselves – lies in how much additional value can be created once the deal is done.

This is why value creation has become a central theme in modern insurance M&A, especially in a market where acquirers – specialist consolidators, PE‑backed platforms, and large players – are competing not just on price but on their ability to run the business better.

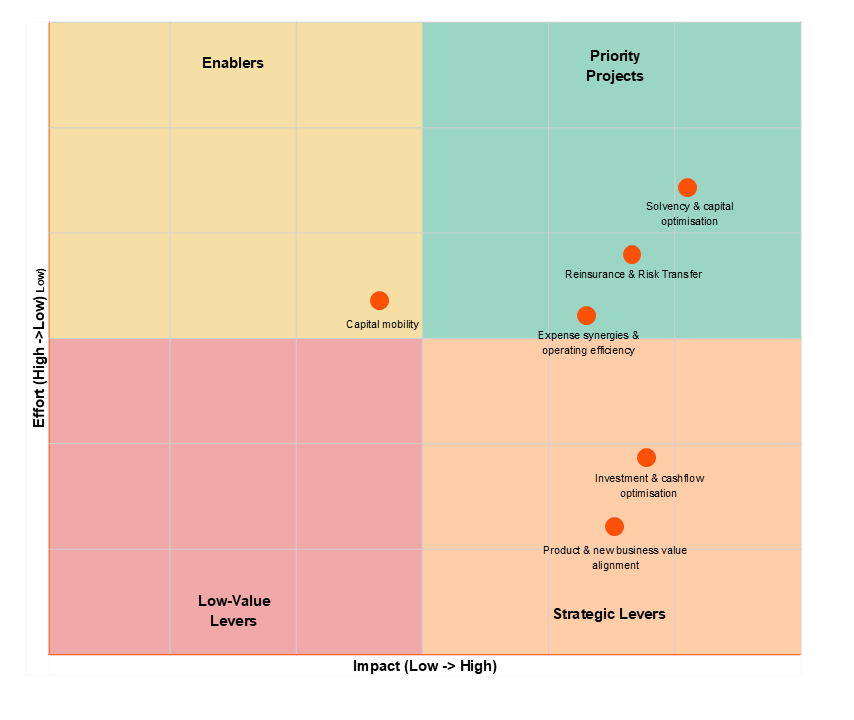

Comparison of optimisation tools and their impact

Before exploring each lever in depth, this visual summarises where the highest‑impact value drivers typically sit relative to effort and shareholder uplift.

The big‑bet levers that move the needle

Solvency and capital optimisationImmediate value can often be unlocked on Day 1 through targeted balance‑sheet actions: refining reserving assumptions, simplifying intragroup structures, optimising capital instruments, and applying solvency tools (MA, VA, TMTP). These actions strengthen solvency coverage and release trapped capital, often contributing significantly to the uplift from Solvency II own funds to full appraisal value.

Capital structure optimisation, including subordinated debt and other liability‑side actions, fits naturally within this broader capital‑release theme.

Reinsurance and risk transfer

Reinsurance programmes – longevity swaps, quota‑shares, stop‑loss arrangements – reduce earnings volatility, reshape risk, and release capital. Effective structuring supports stable distributable earnings and strengthens the buyer’s IRR. Risk‑transfer solutions also complement solvency optimisation and investment strategies by reducing the volatility that otherwise consumes capital.

Expense synergies and operational efficiency

Expense efficiencies, while sometimes viewed as “table stakes,” remain one of the most reliable value levers. Eliminating duplicated functions, reducing overheads, simplifying models, and improving operational processes create a leaner, more scalable platform. Operational hygiene –including cleaning legacy issues and harmonising models – strengthens resilience and enhances trust with regulators.

Investment and cashflow optimisation

Investment optimisation continues to be a high‑impact lever, especially in a rising‑rate environment. Aligning the asset portfolio with the buyer’s appetite and capabilities can lift long‑term cash generation through spread enhancements, more efficient hedging, or in‑house asset management efficiencies.

Product and new business value alignment

Product and new‑business optimisation is a high‑impact strategic lever for open‑book businesses. By prioritising capital‑efficient, high‑return product lines and reducing emphasis on underperforming or capital‑intensive segments, firms can materially improve the long‑term value profile of new business. This ensures that growth is accretive to value rather than dilutive, helping avoid the “growth that destroys value” trap. Effective pricing, disciplined underwriting and tighter portfolio steering together shape a more profitable and sustainable new‑business franchise.

Capital mobility

Actions such as simplifying group structures, improving intragroup funding flows, and optimising subordinated debt can enhance capital flexibility and reduce frictional constraints. These measures strengthen capital mobility across the organisation, support more efficient deployment of resources, and reinforce the benefits delivered by solvency optimisation and reinsurance activities.

The value bridge visually brings these levers together, showing how each incrementally extends reported Solvency II own funds to reach the full appraisal value. This illustrates how strategic and operational actions translate into tangible economic uplift.

Key actuarial red flags in due diligence

Delivering this value requires a robust understanding of downside risk. Actuaries play a critical role in surfacing risks that may undermine deal value: assumptions that prove too optimistic on claims, mortality, or persistency; exposures to inflation or behavioural shifts that were hiding in plain sight; weak model governance; and data gaps that make it hard to see the real picture. Early identification and mitigation of these risks are essential. Identifying these early allows buyers to recalibrate expectations, negotiate protections, and avoid costly surprises post-deal.

From due diligence to integration

Many transactions fail to realise expected value because integration planning starts too late. Actuarial insights generated during diligence should inform post-deal priorities, including:

- Alignment of assumptions and methodologies;

- Simplification of product portfolios;

- Harmonisation of pricing and underwriting standards;

- Operational improvements in claims and policy administration; and

- Capital and reinsurance optimisation.

Embedding these priorities into integration plans ensures valuation assumptions become achievable rather than aspirational.

Conclusion: actuaries as deal value architects

Insurance M&A success increasingly depends on actuarial insight – explaining price, shaping integration, and unlocking long-term value. Actuaries are not just “reserve checkers”; they are architects of deal value. The most successful transactions blend actuarial expertise with finance, risk, underwriting, and investment capabilities – starting early and continuing through integration.

What we think

Successful deals rely on informed judgement. Actuaries help shape that judgement, ensuring decisions protect today’s value while unlocking meaningful, long‑term value for tomorrow.

As the complexity of the insurance business grows alongside regulation, actuaries have become central to insurance M&A, translating risk, capital and projection insights into clear value drivers.