In November of 2019, we wrote a blog entitled The story of a single family office and the rain. It’s quite a riveting tale (and also one of our most popular and successful blogs—partly due to its style and partly due to its topic) about the potential dissolution of a fictional family’s wealth due to ill-management and what can be done to counter this.

In this blog, we explain why it’s even more important in today’s world for family offices who want to leave a true legacy to consider a strategic move from a less-institutionalised operating model into a true family-enterprise professional architecture—one that can mature, and is resilient enough to preserve, transfer, protect, monitor and hopefully grow their underlying wealth.

Let’s start at the beginning, shall we?

What exactly is a family office?

Well, they come in various shapes and sizes, but fundamentally, a single family office services one family only while a multi-family office, usually an independent organisation, supports multiple families to manage their wealth.

There is a very famous novel by Thomas Mann, perhaps you have read it (if you haven’t, you really should), called the Buddenbrooks (German: [ˈbʊdn̩ˌbʁoːks]). This book was written in 1901, and chronicles the decline of a wealthy north German merchant family over the course of four generations.

It’s considered the fictional classical arch of the first generation making the money, one-two generations later spending the money, and the third or fourth generation losing the money. In fact, it’s often supposed that most wealth-holding families don’t last more than three generations.

We at PwC Luxembourg don’t believe this is the case, nor do we believe this outcome is inevitable. The picture we see—of European family offices at least—is one with many excellent and resilient organisations that have managed family wealth through several generations. But this doesn’t happen without a level of sophistication and expertise.

Perhaps the Buddenbrooks family wouldn’t have fared so poorly if they had adapted to their changing times and therefore become more resilient? Or sought a bit of professional support?

Inter-generational wealth passes through times of turbulence and times of change that bring both challenges and opportunities. And right now, we are in the midst of a tsunami. We no sooner came out of a pandemic, when a war broke out in Europe, and now another in the Middle East that threatens to upset the global apple cart. These geopolitical events brought with them logistics challenges, an energy crisis, inflation, volatility in the markets and—quite frankly—who knows what else around the corner?

The times they are a-changin! Artificial Intelligence, the acceleration of technological advances, diversity amongst the generations are some serious catalysts for change. How are businesses supposed to deal with this and how can family offices adapt and become stronger in the face of all this?

Tomorrow is a very different picture. Now is the time to get ready.

Let’s set the scene

In the midst of all of this turbulence and change comes what is being called the world’s greatest wealth transfer. Just to really prepare the ground, here are a few facts to set your head spinning:

- The greatest wealth transfer in history is about to occur (or is already occurring). Fortune Magazine puts it at $129 trillion, although estimates vary.

- This wealth transfer will be from the Boomers’ generation to the Millennials’ generation and then on to the Millenials’ offspring. (Millenials are Gen-Y by the way).

- The transfer of wealth from boomers to ‘zennials’ will reshape the global economy: “Over the next 25 years the world is set to become an “inheritocracy”. An estimated $100tn is currently being transferred from the baby boomer generation to their heirs and charities, according to veteran City financier Ken Costa. Almost all the assets from this wealthy cohort will pass down to people born after 1980.” Arjun Neil Alim August 23, 2023.

- According to the Global Family Offices Market Report and Forecast 2023-2028 report, the global family offices’ market attained a value of USD87.18bn in 2022. Aided by the growing number of wealthy families, the market is projected to further grow at a compound annual growth rate (CAGR) of 7.5% between 2023 and 2028 to reach a value of USD133.60bn by 2028.

What makes now any different? Well, we just listed a few really big reasons. As Jefferson de Lima Matias Oliveira, Asset & Wealth Management Director at PwC Luxembourg, said in a published article on Family Offices and Augmented Reality in July 2023:

“Family Offices are meant to preserve wealth across generations—and the next generation is just a heartbeat away. Within the next decade, one-third of family offices globally will see the next generation taking control, hence the timing is ideal for Family Offices to reassess how suitable and digitally efficient their enterprise architecture is.”

On top of this, there are many other elements of suitability to be considered. And that is what we also want to discuss here.

What are the trends in family offices in 2023?

In the PwC report “Family offices are taking stock after COVID-19 -Trends & opportunities,” some notable key areas were identified where there have been major shifts, including governance, transparency, cybersecurity, investments, next generation (NextGen)/succession and philanthropy, and more. This shows that a reshaped landscape and mindset has emerged.

GovernanceFor those family offices operating globally, there can be added complexities such as where to reside, the number of jurisdictions involved, management of local employment and tax laws, among others; …as “Professionalisation” is an emerging trend with wealthy families and their family offices, so is the need for more robust internal controls that can be positively correlated with size, and therefore complexity of a family office.

Around the globe, the need to educate the NextGen is becoming increasingly important for family offices. Questions defining how control will pass, to whom, and how the NextGen will make decisions (unanimous, majority, super majority—and on what terms) has been reprioritised on the agenda for many family offices.

Governments around the world are demanding more transparency from large organisations.

Many tax authorities around the world are formalising review programmes for high net worth individuals, which naturally extends to their family offices. Without adequate structure, good governance and regular oversight, material tax risks can emerge.

Our age currently characterised by uncertainty and complexity has brought more focus to the importance of estate and succession planning. This is directly linked to the topic of business continuity and is an area that family offices should develop, including family statutes.

As explained in the European Family OffIce Report 2022, this is the time for family offices to build their defences, noting that:

“A sizeable 40% of European family offices do not have a cybersecurity plan in place although 24% claim to be in the process of acquiring one. What makes the complacency around cyber-attacks concerning is that almost 40% of European offices have experienced at least one attack in the last twelve months, and 16% have experienced repeated (three or more) attacks.”

Strategic asset allocation has become a priority for most of the family offices that PwC works with, and it’s a cornerstone for long-term wealth preservation. We are seeing an increasing globalisation of investments, and growth in the sophistication and diversification of investment strategies.

As family offices continue to see private equity as a key driver of long-term returns, there is a corresponding trend where additional capital is being allocated to unlisted, private equity-type investments, often cross border.

This trend further increases the international tax complexity for investments as well as the need for more specific due diligence skills and experience. The focus on sound international tax requirements and regulations and thorough due diligence are essential to realising the investment potential.

This trend is on the rise with most families seeking to understand more about the impact investments within their portfolio has on climate change, sustainability, equality, health and the environment.

It has emerged with intergenerational leadership change. Interestingly though, when “Impact Investing”, return on investment isn’t overlooked and remains a priority. This also links back to Gen Z’s expectations and values.

Increasing social awareness and desire to have a positive societal impact through more active giving is a strong trend. This shift resonates with investment strategies, where total impact (purely societal or ESG) is increasingly married with financial returns to varying degrees.

However, there is less reliance on attendance at fundraising events and more focus, especially from the NextGen, on active involvement with charities the family supports.

At the heart of a sustainable family office is the alignment with the family enterprise that it serves. Changing the emphasis of the reward structures includes aligning performance metrics and ultimately rewards for members of the family office.

This can be achieved in many ways, but typically considers roles, responsibilities, asset allocation, compliance, tax and legal matters. From monthly salaries and annual bonuses to short-term and long-term incentive plans, including carry and co-investment opportunities.

On top of these trends, we can further add the impact of inflation on family offices and wealth. Once again citing the European Family OffIce Report 2022, “Nearly 80% of respondents cite inflation as a significant risk to financial markets, with increasing geopolitical tensions coming in a close second. It’s no surprise that respondents view investment risk as their principal concern.”

The Buddenbrooks effect: how to avoid it and prepare for tomorrow

Let’s get back to the famous fictitious family, so infamous in fact that the term “the Buddenbrooks effect” is often used to infer the decline of family fortunes. The question is why do these fortunes decline? There are many reasons given for this phenomenon, such as:

- Infighting amongst the family.

- The family loses control to the bank because of debt or because they didn’t pay their taxes properly.

- Younger generations become disinterested, incompetent, and prefer spending over preservation.

- There is a lack of innovation or professionalism.

And just like in any family, whether the stakeholders in a family office are family or not, disputes arise, and differences of opinion, arguments and unhappiness occur.

But all these symptoms pretty much point to the same illness: owner mismanagement, or a misalignment of values and goals. This is why family offices need guidance and professional support. They gain a better 360 degrees understanding of what is at stake, what they have and what the potential risks and opportunities are.

This isn’t a relinquishing of control, but rather a strategic move from a less-institutionalised operating model into something more institutionalised/professionalised.

One thing is certain, the rate and pace of change isn’t going to slow down. Acceleration is the future. And the dominant trends we listed above—and that list isn’t exhaustive—are going to make tomorrow look very different.

The family offices that are likely to remain strong and resilient are those that can adapt to change. And that may mean adopting an operating model that can embrace all that complexity.

In the aforementioned article by Jefferson Oliveira, he talks specifically about PwC’s Wealth Compass service, a wealth management platform and reporting tool for family offices that provides near real-time visibility into consolidated balance sheets and net worth statements, including liquid and private assets.

But this is only part of our larger diagnostic tool that enables family offices to reflect within a framework, and with PwC’s support on key questions regarding their “future readiness” from an organisational angle.

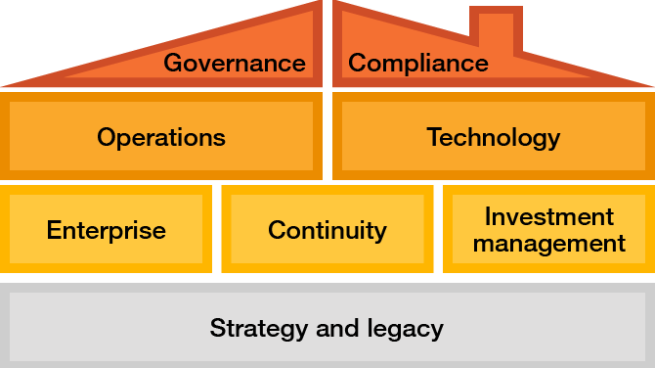

The larger diagnostic tool we offer enables family offices to identify—with our support and expertise—potential risks and opportunities based on eight core pillars: Governance, Compliance, Operations, Technology, Enterprise, Continuity, Investment Management as well as Strategy and Legacy (that is, from vision, governance to operations).

Our benchmarking tool is built around the eight core frameworks identified in PwC’s family office Services and comprises over 200 questions based on best practices for successful family offices. The framework provides a clear outcome for our multi-disciplinary and international teams to design the services you need.

PwC Family Office’s maturity assessment platform – your truthful and honest companion

By serving family offices for many years, we have learned that they are in essence unique, forged by the family values and various management styles.

But even though they are unique, there is always room to make things better. Family offices can certainly operate better and more resiliently, if global best practices are diligently selected and implemented.

The PwC Family Office’s maturity assessment platform has the sole aim to conduct family offices towards a more robust status quo, where family values, ambition, desires, objectives, processes and protocols are carefully assessed and enhanced throughout a collaborative initiative.

What we think

Transiting over centuries of history and legacies can be utterly challenging, especially when approaching it with an it-worked-in-the-past mindset, which can be very inefficient, disappointing and a costly exercise. By collaborating with PwC Luxembourg, we expect family offices to benefit from a very wide and global set of expertises that will certainly make such transitions a success case to be said over the years and to the generations to come.

Jefferson de Lima Matias Oliveira, Asset & Wealth Management Director, PwC Luxembourg