Written in collaboration with Carla Santos, a member of The Blog team.

In 2016, the Luxembourg Stock Exchange (LuxSE) made history by launching the world’s first platform dedicated entirely to green financial instruments: the Luxembourg Green Exchange (LGX).

It started with just a handful of bonds. Today, nearly a decade later, LGX hosts hundreds of sustainable debt instruments from issuers around the world. Over the years, these bonds have channelled billions of euros into clean transport, renewable energy, and climate-resilient infrastructure. More than a milestone, LGX reflects how financial markets are evolving to support both climate and social goals.

Indeed, there is growing recognition that meeting the global objectives set out in the UN Sustainable Development Goals and the Paris Agreement requires a fundamental shift in the financial system. Mobilising capital and redirecting it toward projects with measurable social and environmental impact is a key part of that transformation. That is why green bonds have emerged as important instruments in the transition to a low-carbon and more inclusive economy.

Since the COVID-19 pandemic, the social dimension of sustainable finance has also gained prominence, with a sharp increase in social bond issuances. This growth is expected to continue—not only for social, but also for green, sustainability, and sustainability-linked instruments—driven by mounting urgency in addressing climate change and social equity challenges.

Other factors accelerating this growth include rising awareness, evolving investor preferences, and improved access to reliable, comparable, and harmonised sustainability data. Yet, fundamental questions remain: what truly makes a bond green? How can we ensure transparency and maintain investor confidence? The European Union Green Bond Standard (EU GBS) may offer a long-awaited answer.

In this blog, we explore what green bonds are, the different types available, who the key players are, and the challenges shaping this market. We also take a closer look at the EU GBS and what it could mean for issuers and investors alike. Let’s begin with the basics.

Bonds, simply explained

A bond is essentially a loan that you (the investor) give to a company or a government (the issuer). In return, the issuer agrees to pay you regular interest and to repay the full amount at the end of a set period. For example, imagine you buy a EUR1,000 bond with a 5% annual interest rate and a five-year term. Every year, you receive EUR50 in interest. After five years, you get your EUR1,000 back.

Bond, Green Bond: What makes it really green?

Now, let’s add the word green. A green bond works just like a regular bond in terms of structure and returns. What sets it apart is the purpose: the money raised must go toward projects with environmental or climate benefits—such as renewable energy, clean public transportation, or sustainable water management. Issuers have to specify in advance how the proceeds will be used and commit to transparency through regular reporting.

This idea has since inspired a broader family of so-called thematic bonds, which raise funds for specific environmental or social causes. These include social bonds, sustainability bonds, blue bonds, and more recently, sustainability-linked bonds. To help you navigate the terminology, here is a quick cheat sheet:

Cheat sheet: Types of thematic bonds

| Type of bond | Definition |

| Green bonds | Bonds where the proceeds are used exclusively to finance or refinance projects with clear environmental or climate benefits. |

| Social bonds | Bonds where the proceeds are used exclusively for projects with positive social outcomes (for instance, affordable housing, education, or food security). |

| Sustainability bonds | Bonds that finance or refinance a mix of both green and social projects. |

| Blue bonds | A subset of green bonds where proceeds are earmarked specifically for ocean-related projects, such as marine conservation or sustainable fisheries. |

| Sustainability-linked bonds (SLBs) | Bonds where the financial or structural characteristics (typically the interest rate) can vary depending on whether the issuer meets predefined sustainability or ESG performance targets. Proceeds can be used for general purposes. |

A look into the thematic bonds market

Since the European Investment Bank (EIB) issued the world’s first green bond in 2007, swiftly followed by the World Bank in 2008, the green bond market has grown at an impressive pace both globally and in Luxembourg.

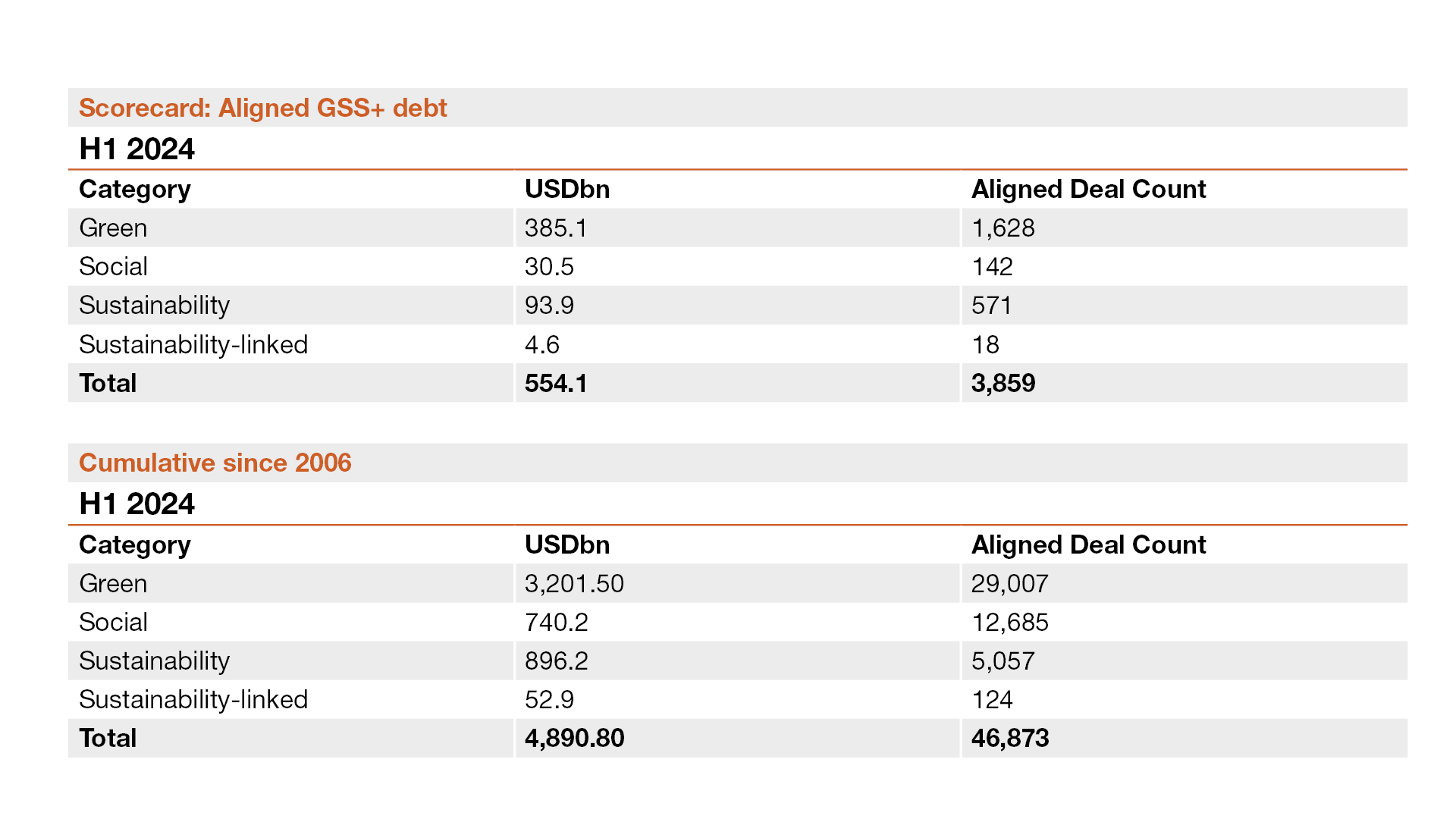

According to the Climate Bonds Initiative’s latest figures, by 30 June 2024, the cumulative volume* of aligned green, social, sustainability and sustainability-linked (collectively GSS+) bonds had reached USD5.1tn.

* Cumulative volume refers to the total amount (in monetary value) of bonds issued over a specific period, typically since the inception of a market or over a defined timeframe such as a year or half-year.

Source: Climate Bonds Initiative

Europe was the leading source of aligned GSS+ issuance in the first six months of 2024, contributing USD291.1bn (53% of the total volume). Africa recorded the most significant year-on-year regional growth, with issuance reaching USD6.6bn, an increase of 412% compared to USD1.3bn from the same period in 2023.

Issuers span a wide range of players, including governments, municipalities, companies, financial institutions, development banks, and supranational entities such as the EIB and the World Bank, as well as non-governmental organisations and UN agencies like UNICEF.

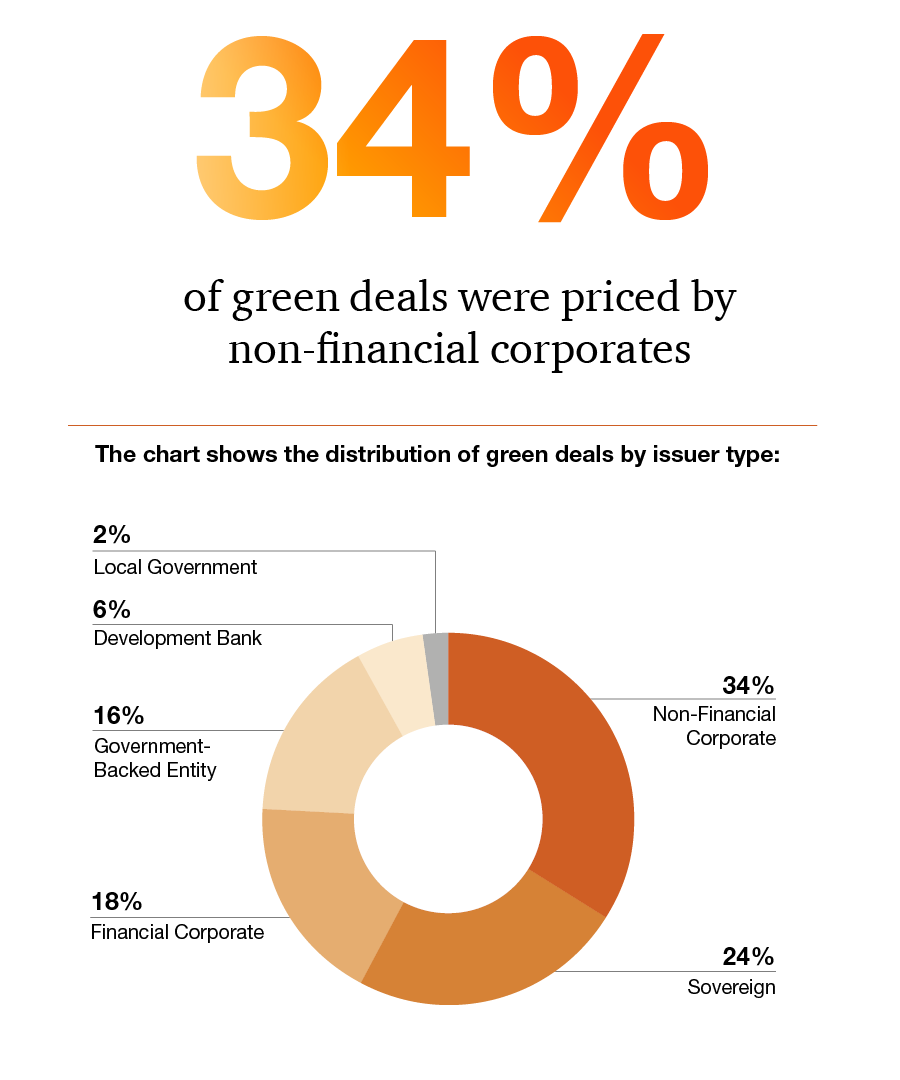

Notably, the private sector is becoming increasingly active. Non-financial corporate issuers made the largest contribution among issuer types in the first half of 2024, with a volume of USD145.1bn—representing a 47% increase from the same period in 2023. For green bonds specifically, non-financial corporates accounted for 34% of the aligned green volume in H1 2024, collectively issuing USD145.7bn, followed by sovereign issuers with a 24% share.

34% of green deals were priced by non-financial corporates

Source: Climate Bonds Initiative

Top green bond non-sovereign issuers:

- European Union (supranational) – USD12.2bn

- EDF (France) – USD9.5bn

- Pattern Energy (USA) – USD8.8bn

Top countries by issuance:

- USA – USD47.6bn

- Germany – USD47.2bn

- France – USD41.1bn

Luxembourg’s contribution

As of writing, the LGX DataHub lists a total of 20,139 bonds amounting to EUR5.183tn. The thematic breakdown is as follows:

- Green bonds: 11,887

- Social bonds: 3,257

- Sustainability bonds: 4,137

- Sustainability-linked bonds: 858

As the numbers show, Luxembourg plays a key role in channelling capital towards sustainable finance. But while the rise of thematic bonds gives hope for a financial system that contributes to a better future, the market still faces challenges—and hasn’t escaped criticism.

On the other side of the coin: the investor perspective

For many investors, green bonds represent both a moral imperative and a financial opportunity. Others remain cautious, still looking for evidence that these instruments outperform traditional bonds. The truth is, investing in green bonds comes with opportunities, but also some key challenges:

- Liquidity: as the market is still developing, some green bonds may be less liquid than their conventional counterparts, making it harder to buy or sell them at the desired price or time.

- Greenwashing concerns: some issuers in carbon-intensive sectors raise concerns. Our view, however, is that even companies in ‘grey’ industries can contribute to the transition. If bond proceeds genuinely finance green projects, it is still a step forward.

- Lack of unified standards: there is no single global standard defining what qualifies as a green bond. Many issuers follow voluntary frameworks such as the Green Bond Principles, but these aren’t binding. This lack of harmonisation can lead to confusion and scepticism.

- Transparency and reporting gaps: investors need clear and reliable information about how proceeds are used and the actual environmental impact of the projects financed. Today, reporting practices vary significantly across regions and issuers, which makes comparisons difficult.

This is where the EU Green Bond Standard can make a difference—by introducing stricter transparency rules, clearer alignment with the EU Taxonomy, and more reliable reporting, it helps give investors greater confidence in what they are buying.

Europe at the forefront of sustainable finance

Europe is leading the way in sustainable finance. A key milestone was the EU’s Action Plan on Financing Sustainable Growth, published in March 2018, which laid the groundwork for several major initiatives—including the European Green Bond Standard. The European Green Bond Regulation, which introduces the EU GBS, was adopted on 5 October 2023. It has applied since 21 December 2024, following a one-year transition period.

This voluntary standard aims to improve the transparency, credibility, and effectiveness of the European green bond market, while helping issuers raise capital for environmentally sustainable projects. By aligning with other key regulations—such as the EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Reporting Directive (CSRD)—the EU GBS also brings much-needed harmonisation, which increases investor confidence.

What does the European Green Bond Standard require?

The EU GBS ensures that green bond issuances are labelled and aligned with the EU’s environmental and climate objectives. It also focuses on strict use-of-proceeds requirements, backed by robust data and reporting obligations. To qualify, proceeds have to finance or refinance activities that:

- Substantially contribute to at least one of the EU Taxonomy’s six environmental objectives;

- Do No Significant Harm (DNSH) to any other goal;

- Comply with minimum social and governance safeguards;

- Meet the EU Taxonomy’s technical screening criteria, where available.

By introducing clear criteria, the EU GBS helps channel capital into projects that genuinely support Europe’s green transition—ensuring that sustainable finance lives up to its promise.

Reporting requirements: what issuers need to know

The EU GBS introduces mandatory reporting and external reviews to boost transparency, reduce greenwashing risks and ensure issuers follow through on their sustainability commitments.

- Green bond factsheet (pre-issuance): before issuing a green bond, issuers must complete a green bond factsheet that outlines how the proceeds will support the issuer’s environmental strategy and EU Taxonomy-aligned objectives. This includes the expected environmental impact, allocation details, and timeframes. A pre-issuance external review of the factsheet is required to confirm alignment with the EU GBS.

- Allocation report (post-issuance): issued annually until full allocation, this report explains how the bond proceeds have been used and whether they align with the EU Taxonomy. If proceeds support projects that will become taxonomy-aligned over time, a CapEx* plan must be provided, including milestones and deadlines. A post-issuance external review must assess the use of proceeds and be published within 270 days after the year-end. Issuers must give reviewers at least 90 days to complete this assessment.

- Impact report: published once after full allocation, the impact report outlines the environmental results achieved through the financed activities. An external review is optional, but it can enhance credibility by confirming the bond’s alignment with the issuer’s broader environmental goals and the EU GBS.

* Short for Capital Expenditure plan. In the context of the EU GBS, it’s essentially a roadmap showing how the funding will support a company’s transition to greener operations over time.

Our take: why the EU Green Bond Standard matters and how to prepare

The EU GBS is set to play a key role in strengthening the green bond market, which is poised for continued growth. By bringing harmonisation, it allows investors to more easily compare issuances and place greater trust in them.

From a regulatory perspective, it introduces a clearer framework and more robust checks, helping to reduce the risk of greenwashing. That said, greenwashing—like fraud—cannot be eliminated entirely by regulation. But the EU GBS is a significant step forward, as it sets higher standards and encourages greater transparency.

Some issuers remain hesitant, given the standard’s recent introduction and some uncertainty around its application. Still, we believe that over the medium to long term, the market—at least in Europe—will adopt it. The EU GBS provides consistency across borders and aligns well with broader sustainability reporting efforts, such as the CSRD. Over time, green bond reporting is likely to become a natural extension of the sustainability disclosures companies are already preparing.

We don’t see this as a burdensome regulation. Rather, it is a practical guide for how to report in a credible and consistent way. While it does require additional effort—from reporting obligations to external reviews—it can also enhance issuer reputation and potentially improve access to capital.

Our advice to issuers: start preparing early. Upfront work is essential to avoid reputational risks and to meet investor expectations. Being ready to report isn’t just about compliance—it is a clear signal of your commitment to the green transition.

What we think

The green bond market continues to evolve rapidly, driven by investor demand and a growing recognition that sustainability and performance can go hand in hand. The EU Green Bond Standard is a key step in building the trust and transparency needed to scale that momentum.

The EU Green Bond Standard is not just a new regulation—it is a milestone in the harmonisation of sustainable finance reporting. By setting clear, data-based requirements, it gives issuers a framework to align with credibility and clarity.