Why is financial literacy increasingly important? With the current world pace, demographic shifts, the rise of technology and an expected resource scarcity, younger generations face a less certain financial future than their grandparents did, and they’ll need to equip themselves for long-term financial security. Some experts attribute the financial crisis that started in 2008 to a consumption-led growth where private debt became unaffordable. We don’t want to over simplify the complex drivers of such a colossal crisis but the lack of financial literacy can be surely counted as one of them. In this article, we dig into what financial literacy means, we go through some remarkable European experiences and we analyse the case of Luxembourg. Is the country doing well? Find out below.

What finance literacy means?

In simple terms, financial literacy is a fundamental skill individuals need to acquire, ideally from a young age, for responsible use and control of personal finances. Financial literacy encompasses decision making for investments, real estate, university funds, budgeting and tax planning, to name just a few. In addition, it might also include skills like attention to detail (i.e. reading of financial contracts), legal knowledge (i.e. consumer rights), the right use of technology, and notions of the global economic reality.

All the above-mentioned subjects go around developing confidence, the state of mind that let people make better decisions, based on knowledge and information. Stakeholders from the public, private and third sectors are key to putting in place more comprehensive financial literacy strategies.

Which European countries are ahead in financial literacy initiatives?

Financial literacy is a long-term educational investment that calls for the involvement of several stakeholders from different sectors and fields. According to the Insurance Europe Financial education in a digital age 2017 report, a few countries stand out for their ability to implement financial literacy in the national agenda with successful results. We’ve chosen three examples for their participative approach involving the public and the private sector:

- The Netherlands

In 2008 the Netherlands launched the Money Wise Strategic Action Plan which was revised with a new timeframe from 2014 to 2018. Created by the Ministry of Finance, the Central Bank, the National Institute Family Finance Information (Nibud) and the Dutch Association of Insurers (VVN), the main objective is to put financial literacy on the national core projects. For example, the National Money Week, where primary school students learn how to deal with money; and the Pension3Days, a national three-day event designed to bring awareness on raising pension.

This action plan counts with the support of over 40 partners from the financial sector, the government and consumer organisations that are part of the Money Wise Platform. This initiative allows its members to collaborate and join expertise to take responsibility in financial behaviour. By joining forces, the platform goes in depth on three crucial components of responsible financial behaviours: financial planning, monetary management and selecting the right financial products. Among the strategies they implement and deploy on a national level, this colligation knows that to maximise impact they need to work together, invest in professional development and innovation, and focus on specific target groups.

-

- Latvia

Latvia developed a national strategy plan for financial literacy with a timeframe 2014–2020. In a first stage, participating parties agreed on a definition of financial literacy, the KPIs, the strategies to achieve them and the resources needed to achieve them. The developed initiatives focused on four specific goals: the development of financial planning, the advisory on the use adequate financial services, encourage decision-making and national financial sustainability. Initiatives included the Financial Education Week, which focused on informing students of all ages about financial responsibility and the Global Money Week. The Financial and Capital Market Commission (FCMC) plays a crucial role as national entity responsible for the promotion of financial literacy, and the developer of an online measuring-tool of financial literacy in a national level. The major, long-term initiative was the creation of an online course entitled Financial Literacy for Adults.

- Latvia

- Croatia

In 2015, Croatia adopted a national financial literacy strategy with the timeframe 2015–2020, a response to the proposal of the Croatian Insurance Bureau to the Ministry of Finance in 2011. The objective was to show that continuous collaboration of both public and private entities could radically change the numbers of financial illiteracy, and, ultimately, have a positive impact on society and local economy. The developed initiatives went in depth into insurance, from its importance, what types are available to how it can impact their future. The main initiative is the participation of the Insurance Bureau in a “Programme of Cross-Curricular and Interdisciplinary Contents for Civic Education”, a training that is currently being implemented in primary and secondary schools all over the country.

The situation in Luxembourg

Luxembourg isn’t as advanced as the countries mentioned above when it comes to financial literacy, but the country is waking up. Some national entities such as the Association of Banks and Bankers of Luxembourg and the Financial Sector Supervisory Commission (CSSF) are actively working on financial integration. However, these individual efforts aren’t part of a national financial strategy.

According to the Foundation Idée, the lack of surveys and studies on the matter make the level of illiteracy of millennials and younger generations difficult to assess. A first key step to take is building up a database on the financial literacy of young people over time to have a better understanding of their knowledge and needs. With the baseline in place, the next step is developing a long-term national strategy, deciding who the main players would be and what role they are to play.

Luxembourg’s people and particularly the younger generations and millennials, as in other countries, are making both simple and complex financial decisions. The more informed and prepared they are, the more they will be accountable for their future and the impact of their decisions on the local economy.

The millennials reality and why financial literacy matters

We dedicate this specific section to millennials because of the expected significant impact they will exert in the global economy. To give you an idea of their influential role, they will inherit an estimated $30 trillion over the next 30 years (globally), more than any other generation before.

These assets, though, don’t prevent them from facing the biggest challenges yet: unemployment rates are high, job markets demand new, ever-evolving skills, robots are coming, real estate investments are expensive, financial decisions to make are more challenging, options for retirement are more varied and decisions more complex.

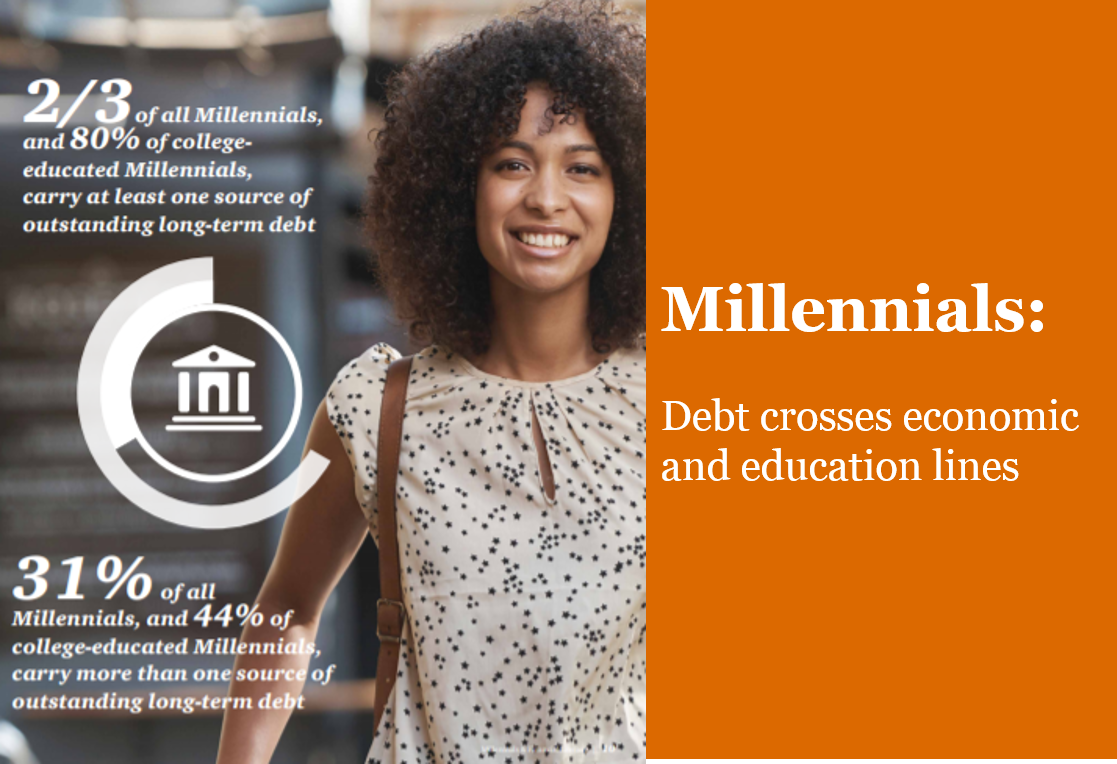

Millennials are likely the most educated generation. When it comes to financial literacy, however, only 24% demonstrated basic financial knowledge according to our study Millennials & Financial Literacy – The Struggle with Personal Finance. The same study showed that 54% of them are concerned about the ability to repay student loan debt. The long-term picture does not get better, because 2/3 of the Millennials will carry at least one source of long-term debt.

Does the future look uncertain for millennials? It certainly does, and the more they prepare for making intelligent, well-informed financial decisions, the more the horizon will be clear. This statement applies to them but also for the Generation Y and the new ones to come. On this regard, Ted Beck, the endowment’s president and CEO, said: “This generation is diverse and highly educated. However, their overconfidence puts them in an extremely fragile financial position, and sadly, they don’t realize it,” Ted Beck, the endowment’s president and CEO, said in a statement.

Together we can! Financial literacy is a public-private team effort

Guiding younger generations toward a financially secure future is an unavoidable agenda for countries that want to remain healthy and face a more sustainable future. Commonly, as citizens, we assume financial education is a government’s responsibility, or that local public agencies or any European Union initiative should take the lead. While that’s a part of the equation, the private sector can also play a fundamental role with a positive impact on both, the people and the business in itself, as the best examples of financial literacy initiatives are showing. Financial literacy is not only about knowledge, but also about developing a sense of responsibility on the decisions people make for their present and the future, from the most convenient student loan, to the best retirement plan. It is a progressive education process where different stakeholders should intervene.

Some actors can play roles that are more decisive at certain stages of the financial education process. For example, when it comes to children and adolescents, schools and non-profit initiatives take the lead, but financial institutions can offer parents playful yet well-designed programmes for their children. For millennials, banks, wealth managers and technology players have an incredible opportunity to teach them and attract them.

New generations are either digital natives or digital native-immigrants (terms coined by Marc Prensky in 2001), and have grown up with a sense of authenticity and trust when interacting with technology and the companies that create them. This trust opens the door to the development of education programmes where digital platforms are the most recommendable means to capture the attention of new generations. They also allow for more customisation.

By providing enjoyable, responsive and dynamic learning resources and platforms, businesses tackle two goals. On one hand, they help millennials and older members of the Generation Y (the one than came right after them) understand “how to” save, invest, open a business, pay taxes, etc. On the other hand, the opportunities multiply and the trust gained becomes a real driver of present and future business.

See below a list of best practices Alison Gilmore, PwC US Asset and Wealth Management Marketing Leader suggests as best learning resources:

- Articles and videos organized around life events such as going to college, growing wealth, buying a home and saving for retirement.

- Unique content based on individual goals and comfort with managing and investing their money.

- Content partnerships with learning partners such as Khan Academy and financial thought leaders like iShares, Investopedia, Forefield, and Morningstar

- Gamification to enable learners to practice setting goals and making decisions in a simulated life journey while adjusting their behavior based on the outcome, creating an environment where it’s OK to fail and learn through experience.

- Behavioral science and social groups to become part of a community and see how others are learning and achieving their goals.

- Connecting learning with services by teaching financial concepts while showcasing the institution’s services and platforms as part of the end-user experience—transforming learning modules into sales leads.

Why financial literacy matters more than ever before

The need of working on financial literacy is widespread. Thinking that it’s a problem of emerging or developing economies is not only inaccurate; it also leaves consumers and new generations in advanced economies – Luxembourg is in that list – out of the scope. Research shows that understanding the financial landscape, managing financial risks and avoiding financial pitfalls is challenging for individuals, in general. It’s a common thinking that populations with low income and limited education are less financially literate. However, it can also be the case of highly educated consumers with strong purchasing power.

The growing complexity of financial markets make the need of financial literacy urgent. Decades ago, people were choosing between interest rates, different bank loans or savings plans. Currently, though, a variety of financial instruments for borrowing and saving with a large range of options make financial decisions more challenging. More and more, workers are making retirement-related investment decisions, for example. Pensions is, precisely, one of the subjects were efforts to improve financial literacy will have a major impact.

To elaborate on the latest paragraph, the increase of life expectancy means we all have the possibility to enjoy a longer retirement. The aim is to give individuals the basic knowledge and the means to choose the right investments or saving strategies for the future. Social security systems are struggling to remain sustainable and the need for alternative options and making the right decisions about them are imperatives. To guarantee younger generations will be capable to do it as well is a societal responsibility.