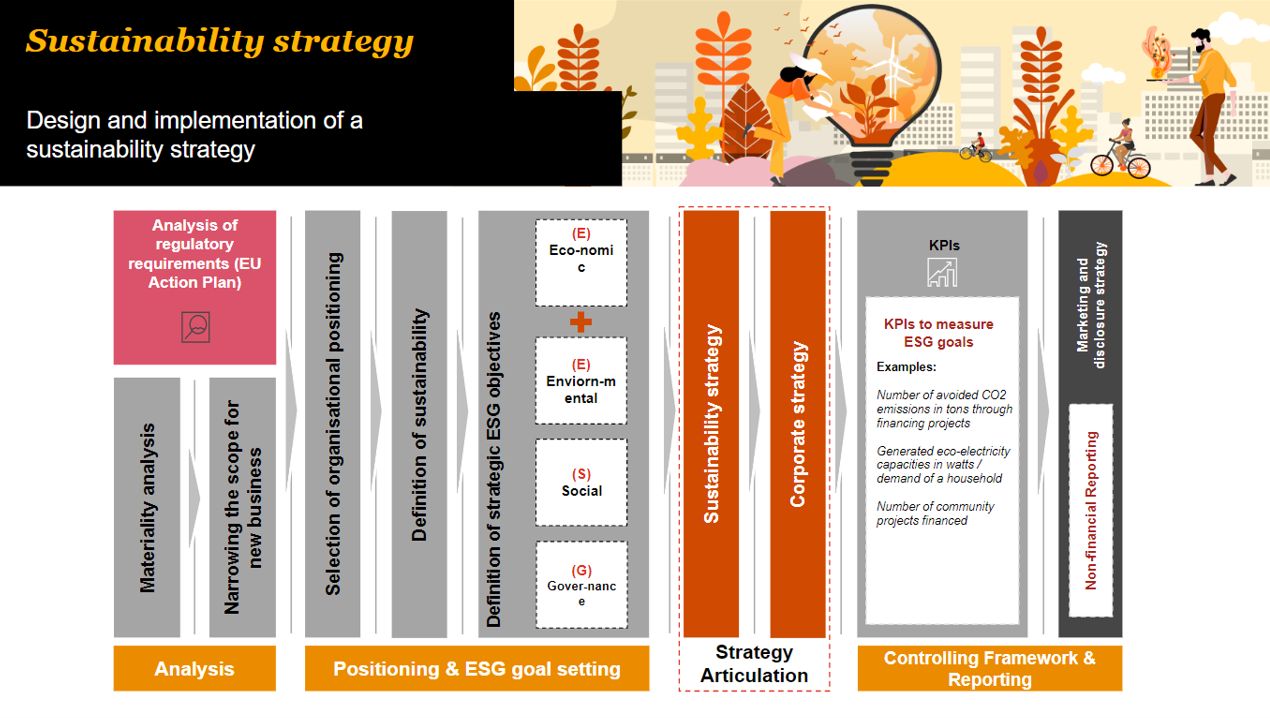

Sustainable finance needs a strategy

Quo vadis Earth? The pursuit of relentless growth in a planet with limited resources, our heavy dependence on fossil fuels, the continuous growth and development of technology on a scale never seen before, climate change and mass migrations. These are only few of the growing global concerns unsettling decision-makers worldwide. …