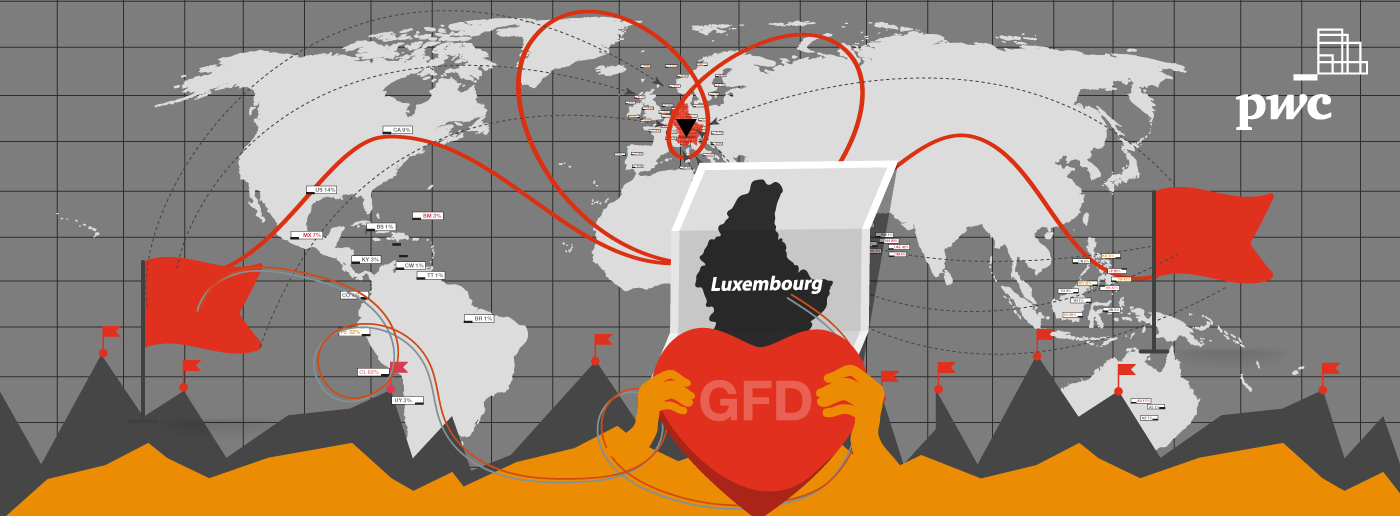

Luxembourg and the Global Fund Distribution market, a love affair

The Beatles said, quite beautifully and simply, “All you need is love”. But we all know that, as much as we wish it were true, that it’s not quite accurate. Relationships are complex, multidimensional and dependent on many variables. There are so many types of love: affectionate love, familiar love, …