The “Sleeping Giant” has awakened, and its emergence represents an era-defining shift in the global economic landscape. China’s rise in the last two decades has been truly meteoric, catalysing an economic expansion of unprecedented proportions. An average economic growth rate of 9.1% between its accession to the World Trade Organisation in 2001 and 2019 is the most convincing proof of it.

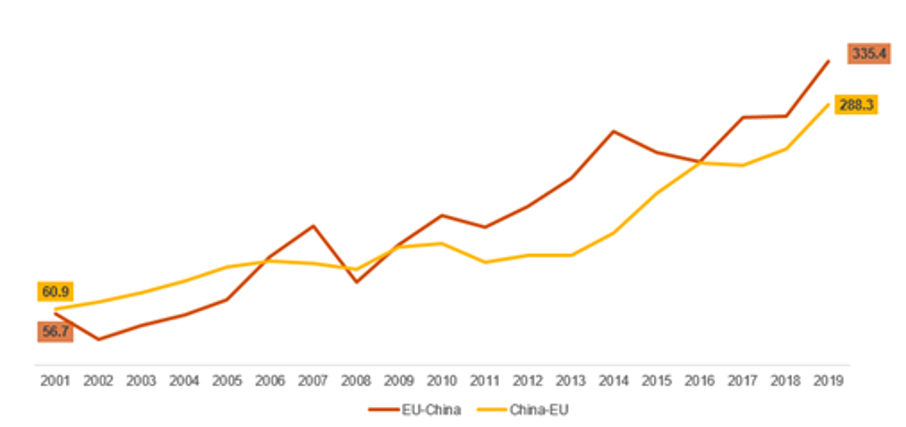

Today, China stands as the world’s largest trader and the greatest domestic market in terms of purchasing power parity. This has brought in an era of unparalleled diplomacy between China and the European Union (EU), with the jointly-ratified EU–China 2020 Strategic Agenda for Cooperation of 2013 highlighting the commitment of both parties to broaden cooperation with another. Sino-European financial ties reached their peak in 2020 with China overtaking the US as the EU’s largest trading partner.

However, bilateral relations have not been without strain. The rate, scale, and nature of China’s explosive growth has made the West anxious and that comes with little surprise.

This tonal shift hardened further in 2019, with the EU branding China as a “systematic rival”. However, despite the hardening tone on the political stage, the bilateral economic relationship between the two superpowers has shown little sign of weakening.

Make no mistake though, this blog isn’t trying to downplay the very real issues that have caused the increasing impasse between the EU and China. However, instead of focussing on disagreements on the political stage, we are putting forward our perspective based on our professional expertise, namely the financial services (FS) industry.

From our viewpoint, both parties stand to unlock significant opportunities through a bilateral commitment to strengthening their financial ties with one another.

In this article you’ll read about how both the EU and China are facing difficult investment issues, but that they each hold the solution to the other’s problems. The sheer size of the opportunities are staggering and working together holds the promise of extraordinary mutual benefit as seen recently in our joint report with LFF: Beyond the Challenges: The Strength of Sino-European Ties.

The EU-China co-operation: stronger that the financial sticking points

The EU and Chinese financial sticking points revolve around two main pillars, trade imbalances and investment restrictions.

This might seem like a vast oversimplification of the issues at play, but at their core both also hold the same realisation: they need each other.

The recent wave of regulatory liberalisation and internationalisation in China which, in turn, has stimulated a true surge of European players looking to provide their services in China and vice versa is a vivid example of this realisation. Upcoming regulatory developments will have a massive impact on the financial sector for Chinese and EU companies in the near future.

These facts show that we can work together and benefit mutually; we already have a track record of doing so.

The situation in China

China’s favourable economic outlook and its ever-expanding middle-class – which, in turn present a valuable opportunity for European players – bolster the country’s potential for sustained economic growth over the foreseeable future.

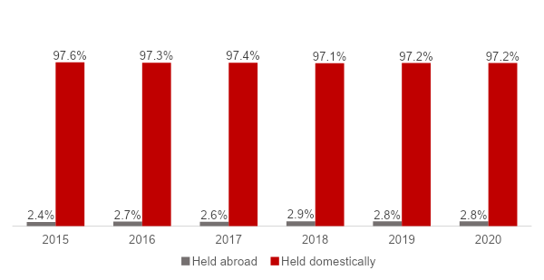

As of end 2020 Chinese banks held an astonishing EUR 27.8tn, fuelled primarily by a high saving rate. However, as the country’s decreasing interest rates make it an increasing burden for the Chinese economy to absorb this high amount of savings, we are likely to see an increase in the proportion of the country’s middle class turning to capital markets in search of higher returns.

Along with this boom in the middle-class, China has also experienced a steep increase in its high net-worth individuals (HNWI) figure in recent times, with the number of Chinese investors whose investable assets exceed RMB 10mn (EUR 1.3mn) skyrocketing from 300,000 in 2008 to 2 million in 2018, a quite frankly staggering increase of 567%.

The situation in Europe

European FS players have an opportunity to capitalise on the investment needs of the rising wealthy Chinese clientele and cater their needs. After all, they hold a long operating history, stronger track records, and broader financial product offerings to do so.

For instance, the widening gaps in the Chinese pension and healthcare systems will raise demand for the global management experience, digitally enhanced operating models and brand value that EU insurance players are known for.

Given the current struggles faced by European capital markets in delivering sustained returns, coupled with the region’s widening infrastructure gap and low bank credit growth, it seems only prudent to seek alternative financing tools overseas while simultaneously addressing domestic financing challenges.

By combining the correction of in-house hurdles —especially the overreliance on bank-based lending, with the pursuit of external financing from global markets— Europe could accelerate the pace at which it tackles upcoming demographic and macroeconomic challenges.

How a strong EU-China cooperation can benefit both sides

The strengthening of Sino-European ties can enhance Europe’s access to China’s vast asset pool. China’s massive FS size and fruitful but still emerging capital markets make it a promising alternative for European players.

However, in order to be considered as Chinese investment specialists, European FS players will first need to demonstrate expertise in China’s market dynamics. By partnering up with Chinese players, they could strengthen their credibility.

On the other hand, an enhanced cooperation with Europe could also benefit Chinese players who would gain increased access to an international network of firms and clients.

As one of the major FS leaders, Europe represents a gateway for Chinese FS players to effectively network with their global peers, paving the way to achieve a global footprint that lives up to China’s size and capabilities.

In addition, enhancing European FS players’ access to the Chinese market would lead to the expansion of financial products available to Chinese customers.

This could be particularly useful for offsetting return pressures arising from an asset allocation culture that is heavily reliant on bank deposits and real estate. At the same time, it addresses concerns about currency volatility and illicit capital outflows.

It would also help to satisfy the increasing demand for new products that changes in investment habits and preferences have catalysed, particularly within the growing HNWIs segment.

The expansion of the EU-China cooperation would serve not only to connect players to new markets, products and clients but also allow for important knowledge spillovers and skill transfers, easing the streamlining process for Chinese products and operations.

Europe’s vast know-how in the sale and management of cross-border mutual funds, for instance, could be useful for China. The implementation of UCITS-like frameworks could help Chinese FS players to gain an edge in the cross-border fund realm, ultimately helping them to expand their geographical scope.

Additionally, Europe’s unmatched experience and capabilities with ESG would be especially helpful in aiding China to overcome its ESG data-related issues.

Forecasting future scenarios for the EU-China cooperation

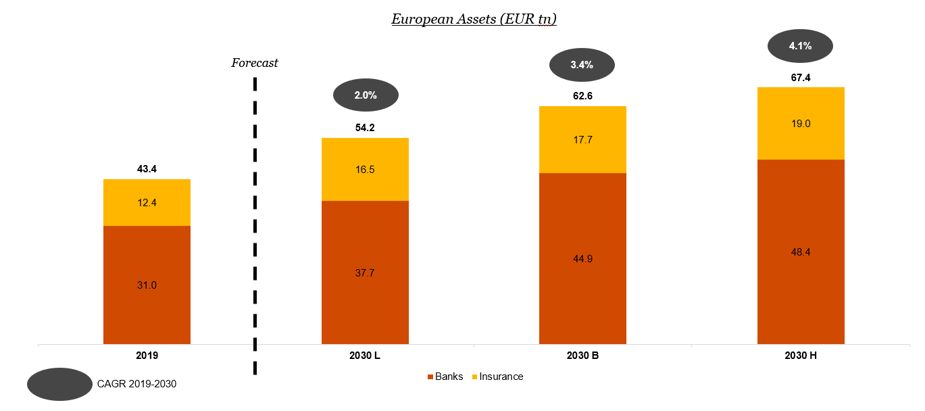

A potential stronger EU-China cooperation within the financial services industry would result in a rise in assets in both regions.

Like we mentioned before, our most likely scenario foresees a substantial strengthening of the EU-China financial relationship. Even if the full liberalisation of China’s FS sector is unlikely to happen and certain key roadblocks will persist, it will be to a lesser extent.

This scenario will see Chinese financial services players diversifying their client base and extending their services to European customers either by expanding their existing operations in Europe or by entering new parts of the European market.

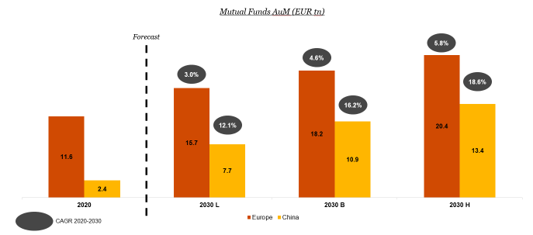

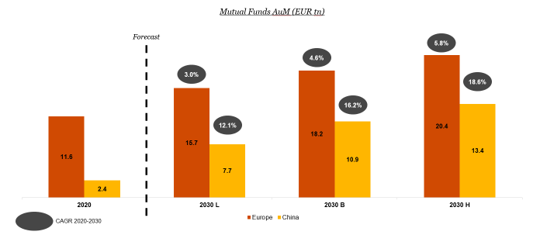

As this occurs, we expect mutual fund AuM in China to rise by a 16.2% CAGR by 2030, instead of the 12.1% growth CAGR expected 2030 may the status quo be maintained. This represents an additional EUR 3.25tn increase in China’s asset base.

For Chinese banks, we expect that assets would increase by a 7.9% CAGR as expanded operations to Europe would drive further growth in their client base compared to the expected growth CAGR of 6.7% if nothing changes. The difference between the two points corresponds to EUR 8.46tn.

For Europe, we expect increased presence within China to increase mutual fund AuM by a 4.6% CAGR by 2030 (corresponding to an additional EUR 2.48tn) instead of 3.0% if nothing changes. As European banks expand their client base further into China, we expect assets of European banks to increase by 3.4% CAGR in comparison to the status quo which would see a 1.8% CAGR and EUR 7.14tn foregone. Insurance and pension fund assets should also see a rise of 3.3% and an additional EUR 1.2tn of assets, up from the status quo of 2.6%.

What about the best case EU-China cooperation scenario?

Finally, we decided to investigate what would happen in a best-case scenario. This admittedly, highly-unlikely event would require an agreement that includes an almost total elimination of technical barriers and implementation of significant reforms on both sides.

Under these conditions several eye-opening figures become apparent. We expect mutual funds AuM in China to increase by 18.6% CAGR by 2030. This translates to an additional EUR 5.76tn of AuM. In addition, with fewer restrictions in place, the assets of Chinese banks could grow by 2030 at 9.0% CAGR instead of 6.7% CAGR, adding EUR 17.37tn in the sector.

On Europe’s side, we expect a growth of 4.1% CAGR in European banking assets, while mutual fund AuM is set to grow at 5.8% CAGR by 2030, a net gain of EUR 15.42tn in additional assets. Moreover, insurance assets would grow at 3.9% CAGR by 2030, well above the 2.6% CAGR projected within the status quo. In this case, the growth translates to an additional EUR 2.48tn in assets. Like mentioned, this represents an unrealistic scenario, but perhaps it should serve as an incentive for all of us to work towards.

Wrapping up

The megatrends highlighted throughout this blog urge for the creation of a truly cooperative, reciprocal relationship between the EU and China.

The strength and effectiveness of this relationship, in turn, hinge mainly on the extent to which the two economic powerhouses are able to establish genuine mutual trust. This trustworthiness involves the recognition and acceptance of ideological and cultural variances, while simultaneously respecting each other’s sovereignty and independence on internal affairs.

There are a couple of key points we all need to realise: firstly, China and Europe are already linked intrinsically through trade and investment; and secondly, this blog is specifically setting out the financial case for increased cooperation between the two blocs.

Such agreement may well serve as one of the greatest financial win-win scenarios in history, but it can only happen with trust and an understanding that we need each other.

If you want to learn more about the EU-China prospects, click here.