The finance function in the alternatives industry has grown in complexity and the tendency seems to continue. In addition to the more intricate business structures as well as the increasing external stakeholders demands, joins the variable “digital transformation” that’s shaping the algorithm of the future.

Designing a finance function that delivers value is cumbersome, especially nowadays when it increasingly provides support to critical aspects of the business. The selection of a suitable operative model plays a critical role in the design, particularly for investors in alternatives. Indeed, the requirements of alternative asset management call for a model that’s both flexible and, at the same time, customisable.

As a consequence, fund managers in the alternative investment industry have been outsourcing some of their operations. Requirements for experienced staff, well-defined processes and appropriate technology are the triggers, the latter being increasingly important because of the growing amount of data to be handled.

And suddenly the Covid-19 crisis happened and caused impacts to the business operating model as well.

Whichever operating model is chosen, market players have to bear in mind that there is a shift to using data and analytics to provide insights that inform strategic thinking to both their own business and that of their clients.

The more data-driven the business is, the better. Tax compliance, accounting, consolidation reporting, and, overall, the growing calls for transparency and accountability in the alternatives industry, require accurate data-driven insights that come from technology which, in turn, also helps to reduce repetitive and time consuming administrative work.

When an outsourcee takes responsibility for certain operation components, alternative fund managers can focus on high value-added work to drive growth while reducing costs. That’s, in fact, the ultimate goal.

This article revisits the main accounting and tax operational challenges that alternative investment fund managers face, and also intends to be a how-to practical tool for them to assess which outsourcee is the best fit to their business.

The top five alternative investment accounting challenges

If maintaining the books of a unique entity under various GAAPs (generally accepted accounting principles) is hardly an easy exercise, bookkeeping for multiple-location entities is undeniably challenging. When, on top of that, one adds the type of activity performed—SPV (special purpose vehicle), master holding, fund, etc—complexity goes a step further because each of them may have unique financial reporting requirements and their needs may be divergent too.

That’s only one example of the multiple operations that the accounting of alternatives investment structures require. What about the preparation of statutory annual accounts, consolidation, NAV computation or the management of intercompany transactions, for instance?

Numerous conversations with our clients have been the best source to define the Top 5 alternative investment accounting challenges.

- The management of a large number of stakeholders and counterparties;

- The multijurisdictional nature of investments, that is growing, and the lack of global data alignment (at least until now);

- Accessing and processing large data volumes (from properties or entities, for instance);

- The management and standardisation of data, because quality diverges as they come from sources with different practices.

- The multiplicity of regulatory compliance and tax reporting requirements. On top of the obligations inherent to each country, there are also specific obligations per investor, per type of investment and per client.

The blended formula: keep the best in house and team up for the rest

Peter Drucker’s quote “do what you do best… and outsource the rest” is countlessly read on the internet when one searches for opinions about outsourcing.

Like any other business operating model or business strategy, outsourcing works when there is an appropriate and timely assessment of the business needs. Needless to say, not all activities can be outsourced, and the definition of sound and clear governance is a must.

When outsourcing, there isn’t such a thing as one-size-fits all. In alternatives, fund managers and other service providers want to bear these three ideas in mind when it comes to this business practice:

- Outsourcing is not about relinquishing responsibility. It is about delegating activities;

- To be successful, it imperatively needs good governance and management;

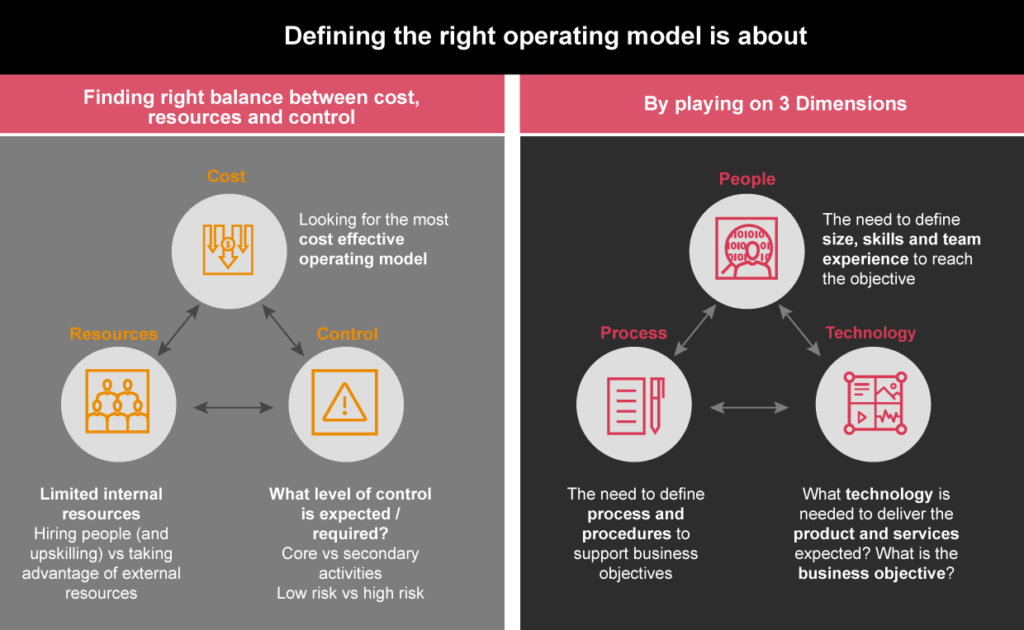

- Outsourcing is about finding the right balance between cost, resources and control.

Revisiting operating models linked to outsourcing and the criteria to choose them

New investor demands, pressing regulatory requirements, and especially the search for cost efficiency, have led businesses to rethink operations, including the finance function. However, while the above-mentioned trigger progressive adoption, major events such as the COVID-19 crisis and technological disruption and the need to adapt and respond to them quickly, can accelerate it.

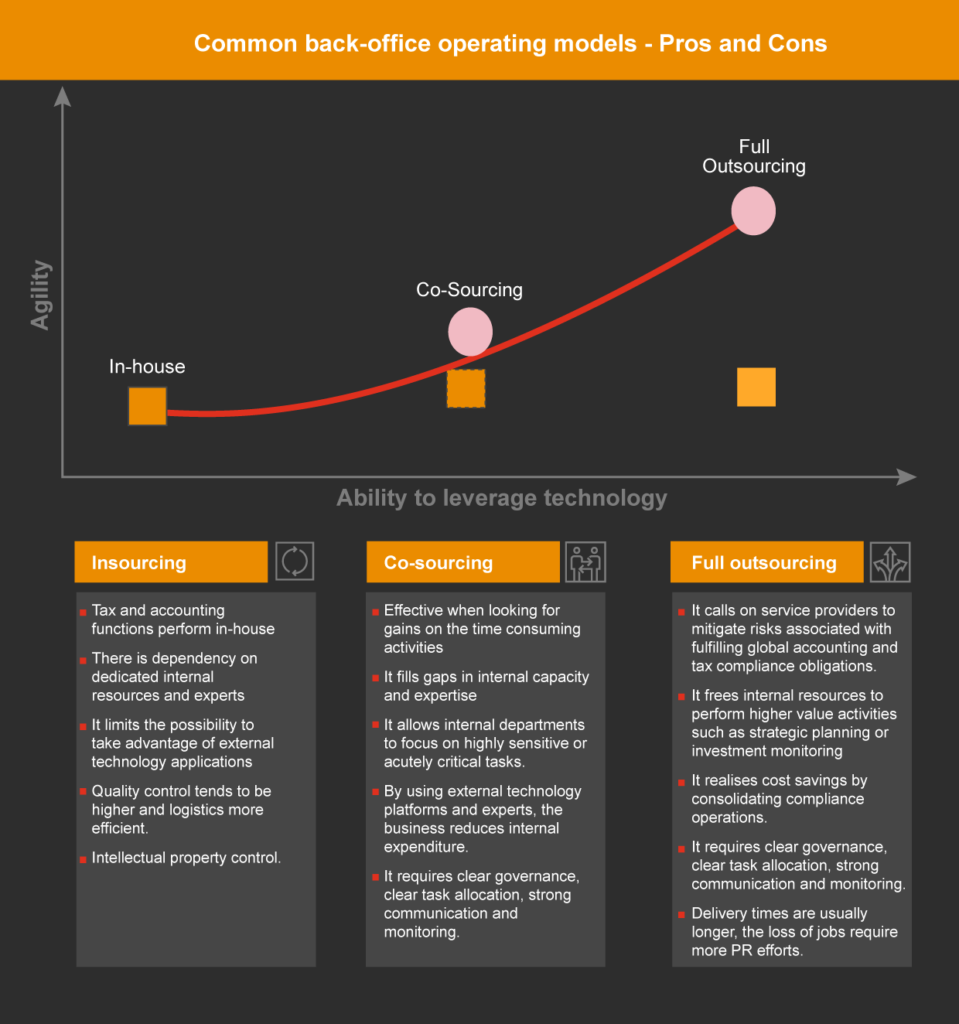

When operations done in-house are not cost-efficient or not core to the business, then outsourcing enters the list of options. As we stated before, the business readiness is key to any decision on this matter. Let’s quickly revisit the most current operating models with these two infographics.

Infographic 1

What defining the right operating model is about

Infographic 2

Common back-office operating models – Pros and cons

Key considerations when outsourcing accounting and tax reporting

Once the decision to outsource certain business operations to alleviate in-house teams has been made, it’s time for the key next step, the selection of the right outsourcee, vendor or partner—as you may prefer to call it.

Most alternative fund managers will run a vendor call, inviting them to submit an offer indicating their availability and capacity to provide services linked to certain chosen tax and accounting operations. However, like any business, the outsourcing firm has to pay special attention to not only the technical aspects, but also the soft skills. While the former are normally well-defined requirements stated in the call’s document, and will be measured with a set of KPIs, the set of soft skills are more tricky to identify and evaluate.

To help out with this process, we have listed the considerations that we think are key for an outsourcing relationship to work as seamlessly as possible.

When screening vendors, pay special attention to their credentials and track record. It would be ideal to get references of how they perform in terms of:

- Industry expertise and team scalability. Apart from the skills and know-how, with generalists and specialists in the industry’s tax and accounting requirements, you want the outsourcee to cope with the workload and any inflection or peak that can happen over time, while maintaining the required quality standards.

- The depth and breadth of the outsourcee’s service offering, and how customisable it is. Should your needs grow, can the outsourcee fulfill them?

- Planning and process discipline, or how they understand your business processes and adapt to them. This requires both the vendor to be flexible in the first instance, but also proactive, to allow room for proposing alternatives to existing processes. That’s why, on your side, it’s also important to be flexible and receptive, and allow for the outsourcee to develop its own ideas.

- The speed of and the process for decision making, that might be linked to the corporate culture or, in many cases, to a different cultural background if the outsourcee is from a different country or from another geographic region or time zone. In this case, a suitable outsourcee would be the one that’s adaptable and aware of the client’s practices and style.

- Communication capabilities, that should be fluent, proactive and timely, and that’s particularly important when the outsourcee is overseas. Language barriers, for instance, can thin or delay the share of information or generate misalignment between both parties. Don’t underestimate the importance of the right cultural fit.

- Technology savviness and availability of the right technology, one that is adapted to the nitty-gritty of the alternative industry’s needs.

The retained organisation, what’s next?

In the aftermath of any outsourcing exercise, it’s important to start on the right foot, with clear guidance on the role the retained organisation plays in the business, and which its performance indicators are.

Simply put, no business can afford to pay little attention to the retained organisation; on the contrary, it’s critical to invest in the startup phase.

In order to maximise performance, the business needs to redefine, ideally participatively, the new purpose of the retained organisation, its structure, its function, its relationship with internal and external stakeholders, the type of profiles, skills and competencies that are required (and career paths), and the KPIs that will account for accomplishment and efficiency.

In the building of the new capacity of the finance function, one cannot set aside the strategic role of reinvesting, i.e. assessing and deciding where to invest the resources resulting from the outsourcing exercise.

What we think

Covid-19 crisis will certainly impact clients’ operating models and cost effectiveness will become even more crucial. Clients who were internalising certain functions like accounting may decide to prioritise outsourcing solutions to take advantage of the flexibility a suitable service provider can bring. Also, clients who were already outsourcing certain tasks may want to reconsider their current operating model to cope with the COVID-19 crisis and its aftermath.