The global tax environment is undergoing a significant amount of disruption. As a response, the Organisation for Economic Co-operation and Development (OECD) published the Base Erosion and Profit Shifting (BEPS) Action Plan. As the cornerstone of the OECD’s recommendations, Country-by-Country Reporting (CbCR) requires multinational groups to include detailed financial and tax information relating to the global allocation of their income. We’ve discussed with Marc Rasch, transfer pricing expert to shed light on what’s at stake for Luxembourg taxpayers.

Country-by-Country reporting in a nutshell

Multinational enterprises have now to include detailed financial and tax information relating to the global allocation of their income and taxes. In practice, CbCR makes sure that taxes are paid in the country where profits and value are produced. Ultimately, the goal is to promote transparency and accuracy through reporting.

Note that about 40 countries have signed the OECD’s Multilateral Competent Authority Agreement on CbCR (a.k.a. “MCAA”), which requires automatic exchange of CbCR information among these countries.

What we think

Compliance – Clocks are ticking

Clocks are ticking on reporting 2016 activities. So, Luxembourg tax-resident entities that are the Ultimate Parent Entity of a multinational with 2016 consolidated net turnover exceeding 750 million euros fall into this scope. Also, similar entities that prepare consolidated financial statements, or would be required to do so if their equity interests were traded on a public securities exchange, are also concerned.

Note that shareholding relationship exceeding 50% should lead to consolidation.

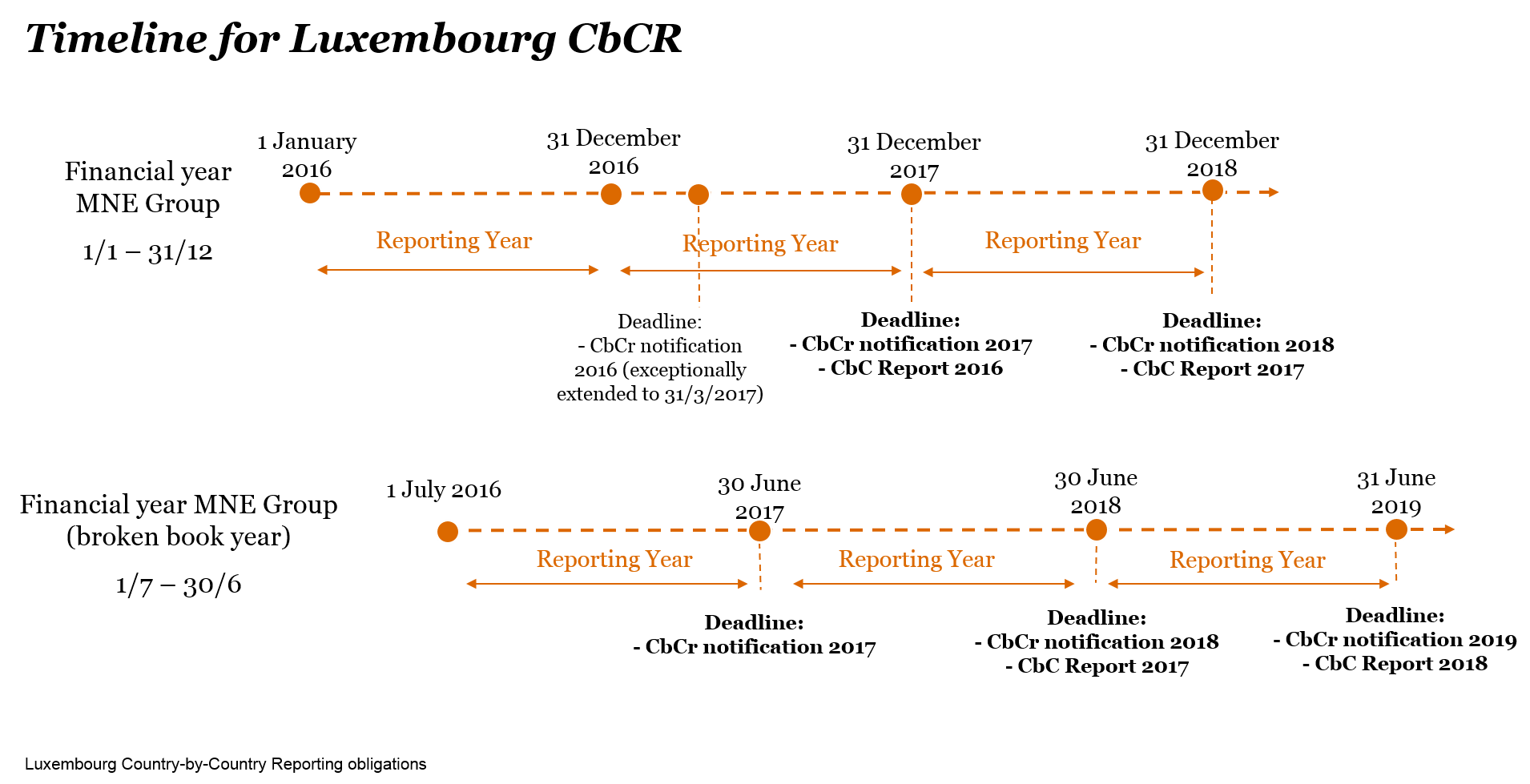

Here’s a timeline to help you comply:

To know more about Transfer Pricing, read this article.

![[VIDEO] Shedding light on Country-by-Country reporting](https://blog.pwc.lu/wp-content/uploads/2025/05/logo-pwc.png)

![[VIDEO] Shedding light on Country-by-Country reporting](https://blog.pwc.lu/wp-content/uploads/2017/10/Visuel-Blog_Marc-Rash.png)