We had the opportunity to exchange ideas about the reality, trends and future of the bank industry some weeks ago, during the Banking Day 2018. We decided to call the event “Banking on the move: embracing new dynamics” because of the ongoing transformation all financial services firms go through. With the rise of Fintech, artificial intelligence and automation, banking is arguably one of the most impacted industries. During more than 4 hours, we had the chance to get a taste of what key Industry players in Luxembourg feel about the changes to come, and how they’ve started tackling digital transformation. Gerd Leonhard, an acknowledged futurist, took part in the event, sharing thought-provoking ideas and predictions, and inviting the audience to start living the future now.

To write this article, we revisited our notes and selected seven remarkable ideas we consider summarise the current challenges the banking industry and financial services in general face. The task wasn’t easy, the event was enriching and full of interesting discussions.

1.- Regulation is here to stay, but it will evolve.

Digital Transformation is pushing industries to make major changes in the way they create value and operate. Banks aren’t the exception. One unavoidable factor joins digital transformation and the need to respond to clients’ demands via customisation: regulation. Evolving, aligned regulation frames the use of new technologies in financial services and protects consumers from any abusive behaviour. For example, the General Data Protection Regulation (GDPR), MiFIDII and the Revised Payment Services Directive (PSD2) are pushing banks to rethink the way they operate and interact with different stakeholders.

A major question, Roxane Haas, PwC Luxembourg’s Banking Leader, asked the Banking Day’s audience was: Are banks done with regulation, or is it still in their agenda? Right after Roxane’s speech Pierre Gramegna, the Luxembourg’s Minister for Finance, commented that regulation will stay but it will evolve, to cope with new technological and clients’ needs.

Are Banks done with #Regulation asked #RoxaneHaas. In fact, this edition of our #BankingDay called “Banking on the move, embracing new dynamics” focuses on regulation challenges, technology and #customerexperience #bkpwcl pic.twitter.com/F5CsNW559n

— PwC_Luxembourg (@PwC_Luxembourg) 6 mars 2018

Minister @pierregramegna at the @PwC_Luxembourg Banking Day: Confidence is key in banking, and don’t forget that #regulation is there to give confidence pic.twitter.com/FhxvNm6mUo

— Claude Marx (@claudemarx) 6 mars 2018

2.- We rarely talk to a banker nowadays. It’s time for banks to reinvent the dialogue.

Among the interesting thoughts Pierre Gramegna shared with the participants, the idea of “a bank in transition” and the need to look beyond the existing customer needs resonated with us. To him, a smart balance of people, data and the management of financial assets are keys to success.

When only sticking with what works in the present, banks are missing future opportunities. Big data, for example, used in a responsible way, help understand what clients expect and what they may need in the future. While this information source exists and it’s ubiquitous, the agenda calls banks for two major actions. Democratising the access to data in the organisation and establishing governance rules to support it, is the first one; the second one is putting cybersecurity as a top priority to guarantee the adoption of safe, reliable user-friendly solutions. Banks aren’t unaware of the cybersecurity challenge though. Did you know that, in our latest CEO Survey, 40% of respondents were extremely concerned about cyber threats?

#Technology and #Banking: “Focus on the magic”. The future is experiences. @gleonhard adds up: “Building stuff that is magic and not

manic or toxic” #bankingday #bkpwcl pic.twitter.com/5aqPipLtW2— PwC_Luxembourg (@PwC_Luxembourg) March 6, 2018

Development of new technologies will be exponential from this point onwards, said @gleonhard. Science Fiction becomes Science Facts #bankingday #bkpwcl @PwC_Luxembourg

— Claude Marx (@claudemarx) March 6, 2018

3.- Banking could be the next wave after media. Prices are going down, and the cloud rises. (Based on a Gerd Leonhard’s statement).

We all testified what happened to the traditional media over the last decade: we got newspapers and magazines on screens, and our fingertips to browse the information; we discovered television and radio on demand and got seduced by them. What’s the next industry to be seriously transformed? Is it Financial Services?

On this regard, Gerd Leonhard elaborates: It’s all moving mobile. Do we need banks? Now yes, but only as an intermediator.

Have you asked yourself when the last time you entered in a bank was? Where do you currently do your transactions and payments? Digital, definitely, is no longer a thing of futurist movies, and digitisation will remain a top priority for Luxembourg banks over the years to come. The country ranks first for technological readiness. This condition eases any path toward digitisation and banks established in the country (139 according to our latest “Banking in Luxembourg” publication) could take advantage of it.

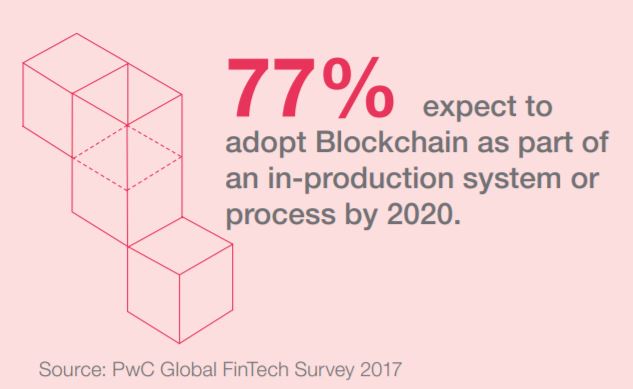

The digitisation of the money is more important than blockchain or bitcoin, thinks Leonhard. He invites banks to take a much broader view towards their future. What’s like to be a bank nowadays and what will it be in the future? he asked the Banking Day’s audience. While blockchain allows processes to be more efficient and reduces costs drastically, it’s also the cryptocurrencies’ enabling technology. Would the adoption of cryptocurrencies generate a positive shift in capital markets and boost new clients acquisition? This chapter of the banking history is to be written yet.

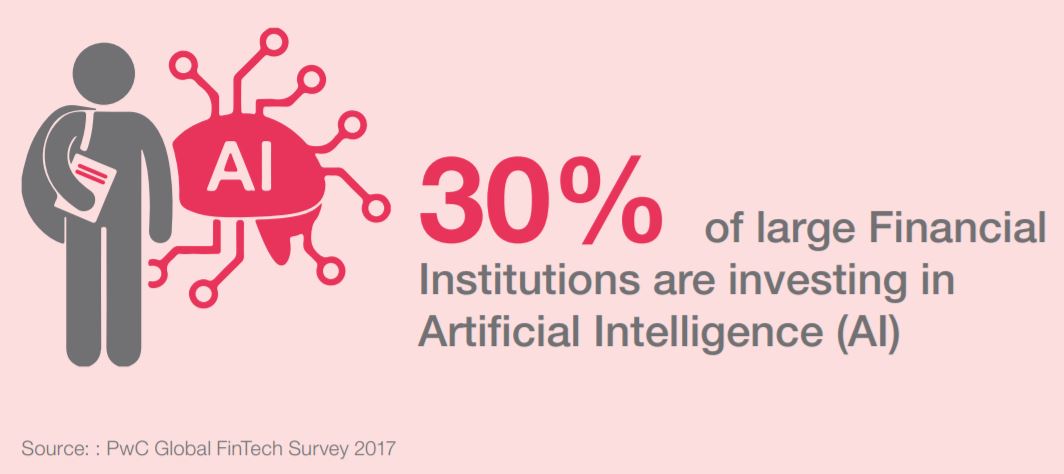

4.- Artificial intelligence is the new electricity

Let’s face it: business, as we know them, won’t look like the same in 5 or 10 years. Even the more stable or traditional industries are facing transformation challenges because of environmental, technological or societal reasons. We all have to adapt; the clock is ticking.

Gerd Leonhard asked the audience: “Why doesn’t banking work like Facebook? Why isn’t it as easy as Gmail?“. We already see companies such as TD Ameritrade working on bots to allow customers to do transactions on Twitter. Users in China, for example, can trade funds via Wechat, all a click away.

Data is the new oil, AI is the new electricity @gleonhard #bankingday #bkpwcl @PwC_Luxembourg pic.twitter.com/v1S8OOTCIs

— Claude Marx (@claudemarx) 6 mars 2018

Robots can improve the operational efficiency of banks. From Robotic Process Automation (RPA) to artificial intelligence, these new technologies are reshaping financial services, demanding new digital proficiency. STEM skills (science, technology, engineering and math) are essential for the new generations of workers, at all levels and industries.

5.- Repetitive tasks are coming to an end. It’s time for brainy, more human work.

Should we be scared of robots? The fact that human interactions and analogue experiences will be increasingly valuable in the future was one of the most powerful ideas Gerd Leonhard shared with the audience. To him, computers will not replace us, but they will replace our routines, and this is a big challenge to our system. He suggested to us to start forgetting the routine, because computers will take care of that.

« #Everything that can be digitised, will be ». Here are the #megashifts to embrace according to @gleonhard #bankingday#Digitisation#Datafication#Cognification#Virtualisation #Disintermediation #Personalisation #Automation#Robotisation #Augmentation pic.twitter.com/hH4T9KNUwy

— PwC_Luxembourg (@PwC_Luxembourg) 6 mars 2018

6.- The future is not and extension of the present: businesses either transform or become irrelevant (based on a Gerd Leonhard’s statement)

“Banks have about 7 years to figure out how they are going to make money” argued Gerd. Indeed, business model innovation is one of the most discussed subjects among the banking community. Guessing and addressing next generation needs may be the second one. Who does really know what they will be? Although there isn’t a magic wand to give concrete answers, agile, beta-version mindsets and growth-hacking approaches may help banks to keep moving and adapting until finding the answer. We like to call it “an iteration mindset”. On this regard, Leonhard warns “change is now exponential and combinatorial: wait and see, means wait and die. We just have to look to companies like Nokia or to the German car companies”.

What will remain essential, though, is the need to design for seamless banking experiences, a “banking journey”. The existing challenge is to design both digital and analogue experiences based on how customers behave and what their needs are. Banks addressing generational needs and rapid technology adoption are more prepared for the present, and the future.

When answering the question, “How #AI & Robotics will impact the industry?, one of the participants of the #BankingDay panel talked about “teaming up” i.e. using robot assistants that will free up time for client-facing professionals & advisers to serve clients better #bkpwcl

— PwC_Luxembourg (@PwC_Luxembourg) March 6, 2018

7.- Investment in digitisation should support business models (Based on a Falk Fischer’s statement*)

We all wonder how AI and robotics will affect our economy, our lives, and the industries we work in. Implementing digital technologies isn’t a matter of following the hype, however. That may result in unsustainable processes, failures in technology adoption and a waste of time and resources. Business models are what connect technology with market needs and user demands. When companies adopt technology as part of a more comprehensive approach that is advantageous for the business, employees, clients and stakeholders, they harvest positive results.

Nicolas Schmit, Luxembourg’s Minister of Labour, Employment and the Social and Solidarity Economy, invites companies to think first of what competencies they do have, and then, what competencies they do need.

Thanks @juliusbaer’s Falk Fisher, Keytrade Bank Luxembourg’s Thibault de Barsy, @ABBLbanking’s Marc Hemmerling, @SocieteGenerale’s Thierry Garcia & @nicolasschmit2, Ministry of Employment, to take part it the panel “Trends shaping the future of #banks” #bankingday #bkpwcl pic.twitter.com/OeQ3GBzcaE

— PwC_Luxembourg (@PwC_Luxembourg) 6 mars 2018

What takeaways can you draw from this fruitful exchange of ideas about the future of the banking industry? Digital transformation is truly happening in all financial institutions, at a different pace and depth. The journey has started, from modest and more conservative changes to the banks’ front-end to the reinvention of business models and value creation.

Loudly or silently, clients are demanding new, agile solutions that are accessible and personalised. Soon, we’ll see new market players, and technology giants likely to play an important role in the transformation of the banking industry, at least at retail level. Transforming is a long road. Fill the canteen. Breathe deeply. It’s time to walk.

(*) Mr. Falk Fischer is CEO at Julius Baer Luxembourg.

YOU MAY ALSO BE INTERESTED IN:

- 2030 series: Will robots eventually replace us all at work? (5/5)

- 3 models for Banks to start a digital transformation

- How digital can help Luxembourg banks save money

- Banking in Luxembourg 2018