As a private customer when you purchase a good or a service from your supplier, value-added tax (VAT) is generally included in the price. The supplier is collecting and then remitting the amount of VAT to the relevant corresponding country’s tax authorities.

For companies operating in the financial services industry for example, such as banks, things work a bit differently. Services they provide are often exempt from VAT. This means that when a bank charge you a fee to manage your account, you do not pay VAT on that service. However, by providing VAT exempt services, banks are usually not able to claim back VAT incurred on goods and services they purchase to carry out their activities. The VAT, therefore, is a final cost.

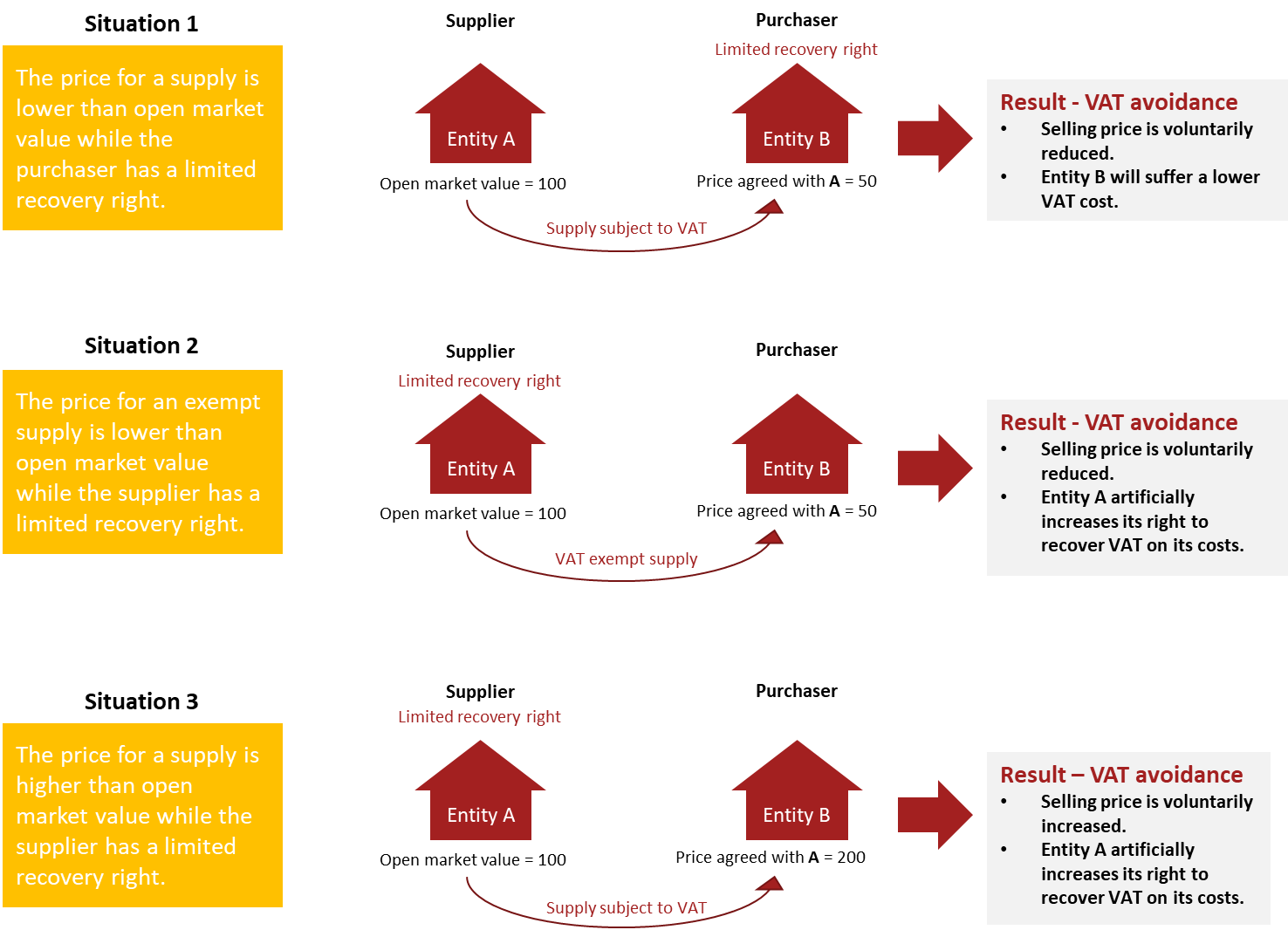

Now, think of entities – or, to put it simply, businesses – belonging to the same group or having economic or other specific ties (they are often referred as “related parties”). What happens when a business provides administrative or support services to related parties? Well, due to the nature of the service provided, VAT will be applicable. If the related parties receiving these services are not allowed to fully claim back VAT on their costs, VAT charged will be a final cost. These related parties may seek to increase or decrease the price for their services compared to market price to mitigate the VAT cost. If this is one of the purpose, then it may become challengeable and questionable.

As VAT fraud is one of the main concerns among EU Member States, the Luxembourg government wants to strengthen its legislative arsenal to fight it. A draft bill currently under discussion before parliament contains the measures needed to prevent tax avoidance arising from transactions between related parties. This article helps you understand how this anti-avoidance mechanism is likely to work in Luxembourg. Let’s get started!

Diving into the Article 80 of the EU VAT Directive

Article 80 of the EU VAT Directive is a “may” provision which means that Member States have the option to implement it or not, as opposed to a “shall provision” which they are compelled to apply.

This article aims at avoiding VAT loss for Member States in specific situations between related parties where the price of a supply of goods or services has been overstated or understated between related parties.

When implemented by a Member State, the corresponding tax authorities can disregard the consideration (or price) agreed between related parties, retaining instead the open market value that would be agreed upon in a transaction between knowledgeable, willing parties who are under no compulsion to act (i.e. independent parties) as the taxable basis for VAT purposes.

Article 80 of the VAT Directive provides for three situations where the anti-avoidance rule is applicable. Being a “may” provision, it is up to the Luxembourg government to determine to what extent the scope of the article should be transposed. In the current draft law, the Luxembourg government kept all the three possible situations:

This measure would only apply to transactions taking place between related parties with familiar or other close personal ties, as well as when they have management, ownership, membership, financial or legal links. It is also important to note that the anti-avoidance rule will apply to both local and cross border supplies.

When a transaction falls within one of the above scenario, the consideration (price) of the supply (good or service) will be either:

- the open market value that would be applicable under conditions of fair competition for comparable supplies; or

- the costs price of the goods or the full costs incurred by the supplier to supply the service.

What about other EU Member States?

Other Member States have already implemented Article 80 in their local legislation. However, the application has generally been limited to one or two of the three rules explained above. That’s the case with Belgium, the United Kingdom and Germany. In other cases, the rules only apply to certain type of transactions. Austria, for instance, has limited the scope of this provision by excluding supplies related to immovable properties.

In general, available guidance on the method the local authorities of these countries use to apply these rules is limited.

The Court of Justice of the European Union (CJEU) has ruled several times on the application of Article 80. Case law gives, however, large flexibility to Member States as long as the scope of this provision remains limited to the three possible scenarios or rules.

Potential consequences

If the Luxembourg parliament enacts bill N° 7278 the way the Government proposed it, the application of Article 80 will have practical implications to any group having entities in the Grand Duchy. To begin with, groups should have in place internal control process together with the necessary supporting documentation. This documentation may have already been established for transfer pricing requirements. In case of audit, one may wonder whether the Luxembourg VAT authorities could request to be provided with similar documentation as the one for transfer pricing.

What we think

It remains to be seen if Luxembourg decides to keep the wide scope of this provision or reduce it to specific transactions, following what other Member States have done. Either way, taxpayers always welcome guidelines and detailed information that help compliance, and expect the Luxembourg VAT authorities to be as clear as possible. In the meantime, we recommend the review of all transactions between related parties/group companies to identify possible transactions in the scope of this new Article 80.