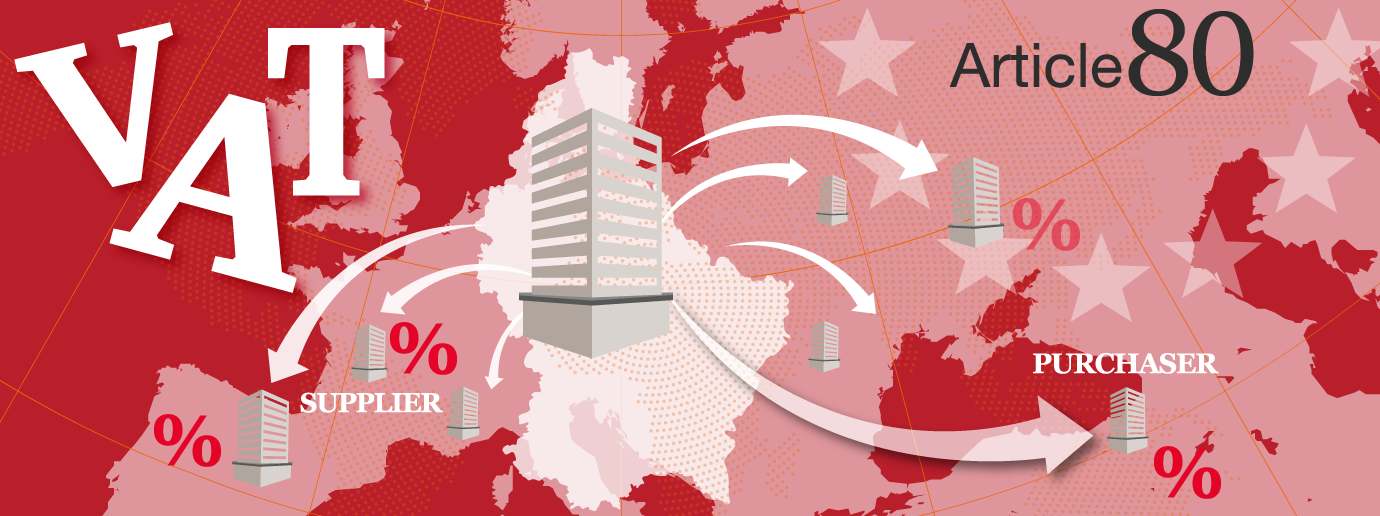

Transfer Pricing and Value Added Tax are getting closer, so what now?

Have you heard about the growing focus of the Luxembourg tax authorities (LTAs) on the value added tax (VAT) and transfer pricing (TP) positions of Luxembourg’s taxpayers? In fact, the global trend is for tax authorities to require more and more information about the local and cross-border intragroup transactions to …

![[VIDEO] Luxembourg cost-sharing exemptions in danger](https://blog.pwc.lu/wp-content/uploads/2017/05/In-conversation-with-Frederic-Wersand.png)