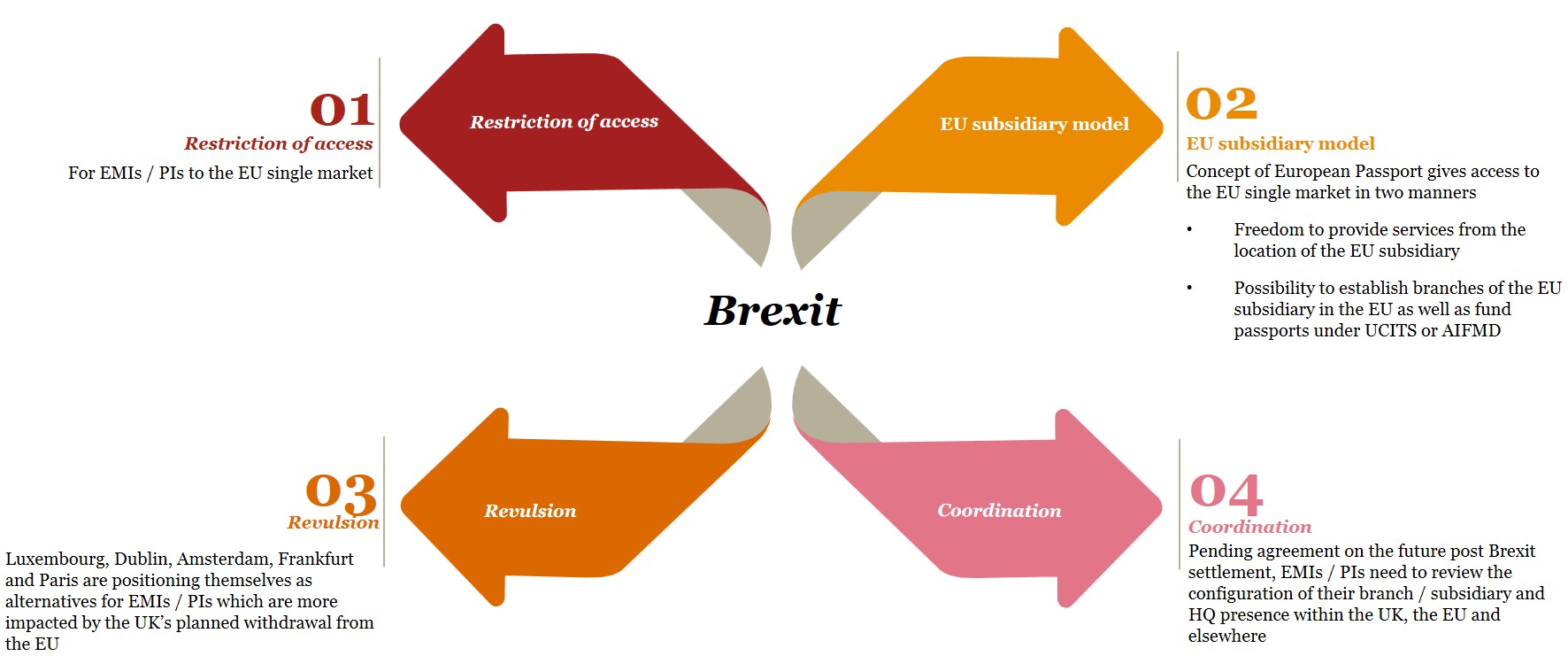

With mobile payments on the rise, Electronic Money Institutions (EMIs) and Payment Institutions (PI) are to play a major role in facilitating the development of payment services. Brexit isn’t going to distinguish long-established financial services companies from new market players. It will affect equally UK-based EMIs and PIs, and traditional banks, fund managers and insurers. Could Luxembourg become the go-to option for these companies to continue accessing the EU in case the Brexit negotiations end up without a deal? Let’s discover below what prospects the country offers.

The urgency to relocate after Brexit

In the Brexit aftermath, Luxembourg, a leading financial centre in Europe, could attract many UK-based FinTechs that wish to retain the access to the European market they have strongly benefited from. In fact, they could operate in any European country using a single licence the UK granted, also called “the European passport”.

If the UK leaves the EU with no deal, these passport rights won’t be longer valid. Recently, the UK’s Financial Conduct Authority, the European Bank Authority and other EU regulators like the Luxembourg’s CSSF, have called financial institutions to get prepared for several scenarios, including the “no deal” one.

Without counting small institutions and other agents, the UK’s Financial Conduct Authority has listed 119 authorised EMIs and 344 PIs. An eventual loss of passporting rights calls many British EMIs and PIs for finding a new EU home and choosing where to apply for a European license. Skipping or delaying this step may affect operations, reduce competitiveness and restrict access to EU markets. Many European Regulatory Authorities including the European Central Bank are already facing high license applications demands from traditional financial institutions looking at the EU.

To find a way around Brexit consequences, many financial institutions have shown interest in establishing subsidiaries or divisions in Luxembourg. Although no EMIs or PIs are on the list yet, some payment services that bet on the Grand Duchy before, show it is a top destination for successful relocations of companies in the financial sector.

EMIs and PIs after Brexit

A glimpse of the political and regulatory landscape in Luxembourg

On 20 July 2018 Luxembourg transposed the second European Directive on Payment Services or “PSD2” into national law. The directive seeks to speed up the development of an integrated market for electronic payments within the EU.

PDS2 wants to lower the entry barriers to the payment services market that traditional banks have dominated until now. Third party providers and FinTechs could become innovation drivers, fostering the emergence of new services and business models.

Luxembourg Authorities’ commitment to creating a business-friendly environment complement advantages stemming from the new regulatory framework. UK-based EMIs or PIs interested in setting up business in Luxembourg need to register in the country and file an application with the CSSF.

A successful licence application procedure for EMIs or PIs takes between 12 and 18 months, depending on the complexity of the business and the quality of the application file. It’s worth mentioning that applicants can use English to fill the forms CSSF requires.

Luxembourg, Europe’s next financial hub?

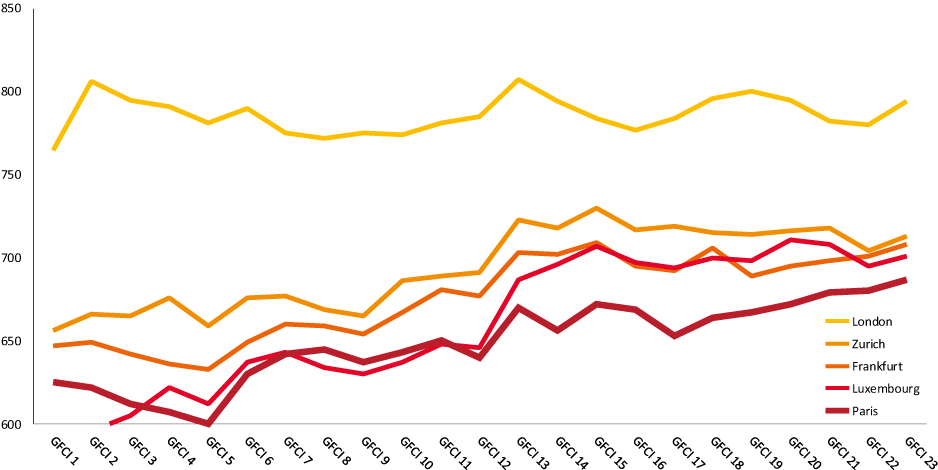

Luxembourg is recognised globally as one of Europe’s most promising financial hubs. It is indeed one of the leaders in digital services and financial technology. According to the latest issue of the Global Financial Centres Index (GFCI 23), it ranks among the top three financial centres in the EU, and 21st worldwide. With London out of the scene, Luxembourg is likely to attract many financial services industry players, including EMIs and PIs.

GFCI 23 Top five Western Europe financial centres over time

Finding a promising business environment

Strategically positioned at the heart of Europe, Luxembourg has a solid international orientation likely to become more relevant in the future. Unique cross-border expertise, multiculturalism, multilingualism and a skilful financial services workforce help build up this reality.

According to STATEC (2017), approximately 71% of the Luxembourg workforce is foreigners. The vibrant professional landscape attracts talent from all over the world and ensures the supply of high IT profiles and financial specialists that any aspiring Fintech hub needs.

There are well-established organisations that support the development of a Fintech Hub in the Gran Duchy. On one hand, Luxembourg for Finance (LFF) works on developing the Luxembourg’s financial centre; on the other, the Luxembourg House for Financial Technology (LHoFT) is a public-private initiative that fosters technology innovation in financial services by connecting and supporting the Fintech community.

Similarly, Fintech companies have access to a range of public and private funding schemes depending on their development stage. A well-established information and communication technology infrastructure is an added factor supporting Fintechs.

There is still homework to do, though. While promoting advantages Luxembourg offers to attract EMIs or PIs is a need and numerous stakeholders are investing time and resources on make it happen, the country needs to demonstrate that it is a hub that attracts, retains and accelerates Fintechs. They want the country chosen as new home to offer a promising and safe future.

What we think

Luxembourg is fully equipped to compete with Paris, Amsterdam, Ireland to attract EMIs and PIs that seek an EU shelter after Brexit. The challenge is to put the pieces of the puzzle together smartly, so the existing advantages – regulatory environment, governmental commitment, technology, institutional support – can work seamlessly. Promotion efforts ideally should ideally run in parallel with Luxembourg developments to put together the most attractive pack for Fintechs.