“Are you reading the future in coffee grounds here, or did you just see the Grim?”

That’s Sophia, waiting for Leonard to free the coffee machine so that she can have her morning cup. Her colleague has been contemplating the content of his corporate mug for a good thirty seconds now—so deeply lost in his thoughts that he didn’t even hear her coming—and it is time for a friendly nudge.

“Oh?” Leonard looks up, a bit startled, taking his smoking hot cup and stepping away. “Sorry Sophia,” he apologises. “I didn’t sleep that well, I guess I really need that caffeine shot.”

“Really? What’s bothering you? Are you expected on the tenth floor to make a presentation to the CEO?” she asks, half-joking, half-concerned. Their bank’s CEO is said to be a nice person, but still, that would be serious business.

“You couldn’t have been more right! Well, not the CEO, just my boss. I’m supposed to outline prospects for the evolution of the Luxembourg banking sector in today’s challenging times, and draft recommendations to the top management. I have an idea of what I need to say, of course, but I’m just not sure where to start.”

“Leonard, you lucky man, I think I may have just what you need. Come with me.”

Leonard follows Sophia to her office, where she picks a booklet on a shelf. “Here it is. Don’t thank me.”

Leonard looks at the cover: Banking in Luxembourg – Together towards another decade of resilience.

“Oh right, a PwC Luxembourg publication! That looks interesting indeed Sophia, I do thank you!” exclaims Leonard, striding back to his desk, already diving into the report’s content.

In this blog, we follow Leonard in his reading of our recommendations to the leadership of the Luxembourgish banking industry to align with the European Central Bank (ECB)’s latest supervisory priorities, as well as with two areas not directly covered by the ECB: Tax- and Anti-Money Laundering (AML)-related matters.

Don’t have time to read the whole blog entry? Then watch our “Blog in 1 minute” video for a quick summary of its main points:

ECB priority 1: Resilience to immediate macro-financial and geopolitical shocks

From the Global Financial Crisis (GFC) of 2007-2009 until mid-2022, European banks operated under ultra-low or negative interest rates—a context that drove certain banks to take on higher risks in pursuit of profitability. This environment sometimes led to a reduced focus on robust liquidity management and heightened risks for banks.

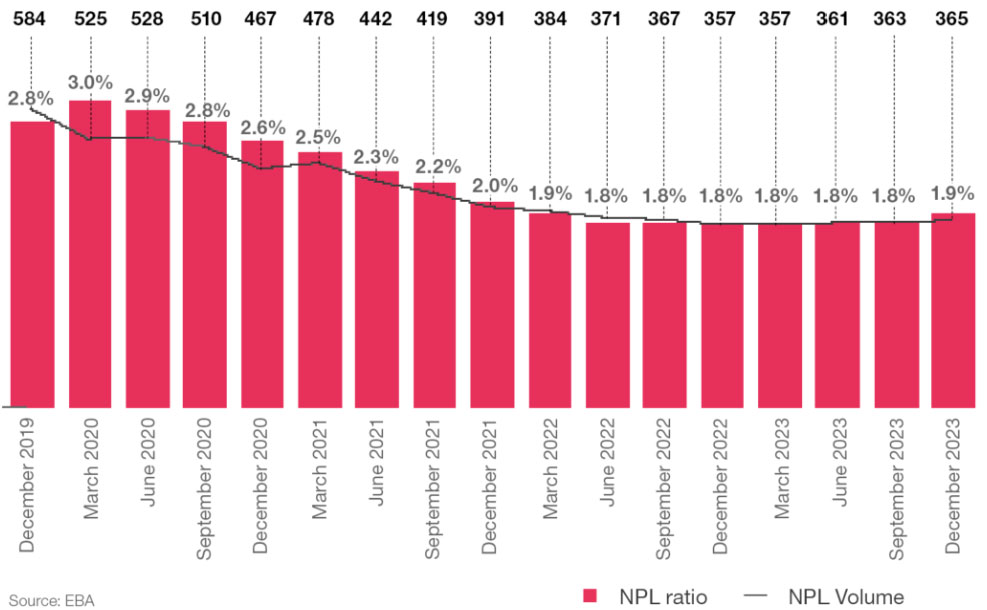

Indeed, according to the European Banking Authority (EBA), the non-performing loans (NPL) ratio across the European Union (EU) and the European Economic Area (EEA) reached 3% in March 2020 just as the COVID-19 pandemic was starting to ravage the global economy—up from 2.8% in December 2019.

Ratio and volume of non-performing loans (EUR bn)

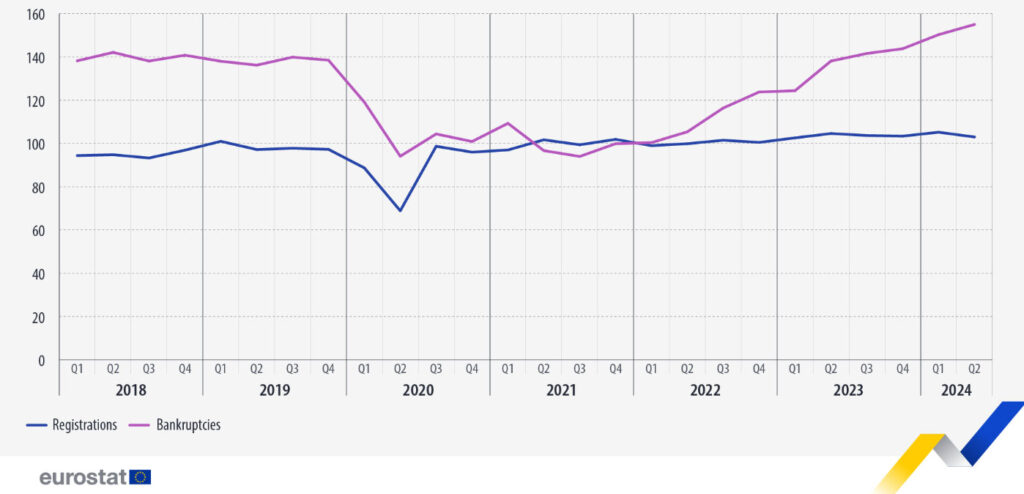

While the NPL ratio and the volume of NPLs has declined since then, the macroeconomic situation across Europe is far from stable, particularly given that bankruptcy declarations in the first two quarters of 2024 have increased.

Registrations of businesses and declarations of bankruptcies in the EU, Q1 2018-Q2 2024

(seasonally adjusted data; 2021=100)

Source: Eurostat

In Luxembourg, the national statistics agency, STATEC, recently highlighted how bankruptcies in the first half of 2024 “rose by 6% compared with the first half of 2023,” and that several sectors in the ‘real’ economy—such as the hotel, catering, and construction sectors—saw notable job losses.

As such, the Luxembourgish banking sector should closely monitor its credit risk management and asset and liability frameworks and make sure they are up to the ECB’s standards.

Strengthening credit and counterparty risk management

In their task of managing credit and counterparty risks, European bankers will find useful—some say crucial—guidance in the EBA’s 2020 “Guidelines on Loan Origination and Monitoring”. While not a formal law, these guidelines are essential in helping banks to maintain high standards in loan quality and risk monitoring, thus ensuring prudent risk management.

The ECB is conducting targeted reviews of sensitive portfolios and on-site inspections on counterparty risk management matters and will review banks’ application of IFRS 9 (although the ECB has no direct authority over accounting matters, IFRS 9’s dispositions affect credit risk provisions and capital reserves, which is why in the ECB’s eyes, the IFRS 9’s influence on loss provisions indirectly falls under its supervision).

Implementing IFRS 9 is no mean feat, as it requires banks to develop sophisticated credit risk models, ensure accurate data collection, and enhance staff expertise. Robust documentation and stress testing are crucial for mitigating risks in this evolving regulatory environment.

In Luxembourg, the Commission de Surveillance du Secteur Financier (CSSF), Luxembourg’s financial regulator, issued Circular 22/824 in December 2022, which incorporates the EBA guidelines into the country’s administrative and regulatory practice.

However, many Luxembourg banks face implementation challenges. Whether it relates to integrating environmental, social, and governance (ESG) factors into credit risk policies, monitoring NPLs, or applying IFRS 9, the banks have a lot to chew on.

Our recommendations- The Chief Risk Officer (CRO) and the Credit Committee, often led by the CRO, should deeply understand the ECB’s guidelines on counterparty credit risk governance. After gathering all necessary information for loan origination and monitoring, the CRO’s risk function must analyse it and ensure compliance with the guidelines. For large loans, such as those financing major industrial projects, the CRO should perform case-by-case analyses.

- The CRO needs to lead stress testing, devising scenarios that include even the most unpredictable events, to assess the bank’s portfolio resilience. Collaboration with the Chief Financial Officer (CFO) is essential here, since the CFO provides key financial data.

- The CRO should also consider environmental risks, consulting the Chief Sustainability Officer (CSO) whenever applicable. Reverse stress tests should be an opportunity to identify extreme scenarios that may threaten the bank’s very viability.

- It is the CFO’s role to ensure compliance with IFRS 9, regularly updating systems to reflect how macroeconomic changes affect loan provisioning and the bank’s business model.

Asset and liability management frameworks

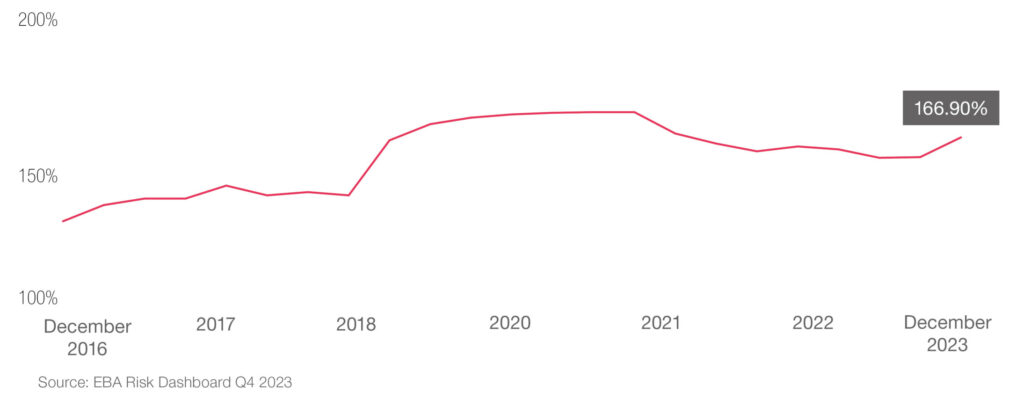

On the liquidity and funding side, the liquidity coverage ratio (LCR) of EU and EEA banks was 166.9% as of December 2023—well above Basel III‘s 100% requirement. Luxembourg’s banks mirror the European trend and demonstrate strong LCRs. In fact, the five biggest banks by balance sheet also surpassed Basel III’s requirement, often with quite comfortable margins.

LCR ratio of EU/EEA banks (December 2016 – December 2023)

With their prudent governance and—until now—improved profitability due to higher interest rates, Luxembourg’s banks are seemingly in a comfortable position when it comes to liquidity and funding.

However, while periods of sustained economic growth generally lead to high LCRs, predicting deposit stability can be challenging, and the slightest reputational issue or better offers from competitors can potentially trigger rapid outflows. In addition, given the overall economic slowdown in Europe, liquidity situation could be adversely impacted on a whim.

This new environment poses potential liquidity challenges, and the ECB plans on assessing banks’ implementation of the Interest Rate Risk in the Banking Book (IRRBB) and stress test their asset and liability management frameworks to ensure they can manage all sorts of risks, including the IRRBB.

Our recommendations- The CRO, with data from the CFO, need to anticipate scenarios where key clients might leave, considering triggers like economic or geopolitical shocks. These scenarios inform stress and reverse stress tests to evaluate the bank’s asset and liability management.

- Nonetheless, this new environment poses potential liquidity challenges, emphasising the importance of stress tests. These tests help banks strengthen asset and liability management, enabling them to manage interest rate risks and shifting customer behaviours. Based on the results of these stress tests, the CEO should develop strategies to manage liquidity and diversify funding, ensuring contingency plans are in place.

- The CEO, together with the CRO, also oversees IRRBB policies, making sure they align with the evolving economic landscape. Regular reviews of the IRRBB framework, either by internal or independent audits, are crucial to maintain its relevance amid changing global conditions, as advised by the Bank for International Settlements.

ECB priority 2: Managing governance and ESG risks

As important as it is, cautious management of credit and counterparty risks isn’t enough to protect a bank and ensure its longevity. The various scandals that have hit Credit Suisse in recent years is a case in point on how failing governance models can put a bank—even one with a venerable reputation and solid fundamentals—in danger.

Therefore, the leadership of Luxembourg’s banking industry can’t afford to take a lax approach to all matters related to the composition and functioning of their bank’s governing bodies. But it doesn’t stop there, as sound governance is also about getting a better understanding of the bank’s exposure to physical and transition risk drivers of climate change. It also focuses on prioritising risk data aggregation and risk reporting (RDARR).

Management bodies’ functioning and steering capabilities

The ECB has identified several governance-related issues which, if left unaddressed, could harm European banks on the long-term.

For instance, CEOs or board chairpersons can sometimes adopt a domineering attitude, which stifles constructive debate and impacts the performance of the board and the senior management. In addition, when board interactions with the staff, be it with the senior management or with lower rungs of the organisation, are absent, boards may fail to fully understand the bank’s operations, performance, and risk appetite.

Another key issue at the board level is gender imbalance. The C-Suite of many European banks remains male-dominated, and although gender diversity has been a focus for a few years now, Luxembourg’s banks could go further and adopt a more holistic approach to board diversity.

Indeed, including members from different age groups balances innovation and experience, while diverse professional backgrounds offer a comprehensive understanding of operations, risks, and opportunities. Cultural and ethnic diversity is also crucial for navigating international markets and regulatory environments.

In addition, a common oversight in Luxembourgish banks is the lack of clear succession plans for directors nearing retirement, which can pose continuity problems, particularly given that boards in Luxembourg’s banks are increasingly getting overwhelmed with compliance tasks, leaving little time for strategic discussions.

Our recommendations- Chairpersons and CEOs set the tone from atop. As such, they must demonstrate openness, humility, and a desire to connect with the bank’s people. Ignoring different perspectives is never a good idea. Chairpersons should recognise that they aren’t infallible, and CEOs should feel empowered to challenge board decisions. Similarly, boards should constructively challenge senior management whenever needed.

- While boards focus on strategy and long-term goals, they shouldn’t be completely detached either from daily operations. Close consultation with Chief Operating Officers (COOs), who understand day-to-day functions, is essential. Boards should schedule regular staff meetings to gather insights and inform strategy.

- Board members should collaborate with the COO, the Chief Compliance Officer (CCO), the CRO, and the internal audit function to understand the bank’s multifaceted risks, anticipate regulatory changes, and identify opportunities. The CCO, responsible for regulatory oversight, should ensure the board is periodically informed about key regulatory developments, helping the bank adapt and capitalise on changes.

- As the ECB and CSSF are going to review the effectiveness of the boards of Luxembourg’s banks, directors should embrace openness and see this as a chance to align with supervisory expectations. Boards and the senior management should proactively engage with regulators for periodic reviews to ensure better governance and understanding.

- Diversity efforts in Luxembourg’s banks should focus on meaningful inclusion, not merely fulfilling quotas. By considering gender, age, geographic, ethnic, educational, and professional backgrounds, holistically diverse boards would better respond to stakeholders’ needs, foster innovation, and promote inclusive governance, enhancing the bank’s reputation and culture.

- A policy defining which documents are to be provided to the board in full and in summary should be set up. Involving the CCO and specialised committees can streamline compliance processes, freeing up time for the board to engage in strategic decision-making.

Risk data aggregation and risk reporting (RDARR): persisting challenges

In a January 2013 publication, the Basel Committee on Banking Supervision (BCBS) introduced the ‘Principles for effective risk data aggregation and risk reporting‘ (also known as BCBS 239) to guide banks in managing risk exposures and identifying concentrations more efficiently.

However, the complexity of data management, governance, and reporting processes has made compliance difficult for many banks. What’s more, constant updates to Key Performance Indicators (KPIs) and data requirements add to the challenge.

In fact, the ECB and a November 2023 BCBS progress report reveal that most banks still struggle with fragmented technological platforms and weak data architecture. Notably, only two of 31 Global Systemically Important Banks (G-SIBs) fully comply with the BCBS’s principles, despite a 2016 deadline.

Although most Luxembourgish banks aren’t G-SIBs or nor do they fall under direct ECB supervision, implementing effective RDARR policies would offer them significant benefits. For example, automated, high-quality risk data reduces manual processes, lowering operating costs. Furthermore, a robust RDARR system greatly enhances risk management and helps steer the bank.

Our recommendations- With the BCBS 239 compliance deadline long passed, the ECB plans to enforce RDARR through reviews, which makes it essential for banks to demonstrate concrete progress in addressing gaps.

- Banks can also consider appointing a Chief Data Officer (CDO), reporting directly to the CEO, who would be responsible for all RDARR-related matters.

- Board members should encourage the senior management to prioritise RDARR, as it provides valuable insights for strategy and determining KPIs. Better data and faster aggregation improve decision-making whenever the bank faces new risks or market developments.

- Given the lack of a one-size-fits-all solution, banks need to address RDARR compliance based on their unique needs. Nonetheless, a key approach would involve collaboration between the CRO and Chief Information Officer (CIO) to address gaps in IT architecture and ensure accurate reporting.

- The CFO should also be involved, as recent RDARR guidelines, including the ECB’s Guide on effective risk data aggregation and risk reporting, have a financial accounting dimension. Assigning clear data ownership is crucial to achieve full compliance.

Material exposures to physical and transition risk drivers of climate change

In November 2020, the ECB published a guide on managing and disclosing climate-related and environmental risks. A stress test two years later revealed many deficiencies and inconsistencies among banks, especially in terms of integrating climate risks into their models and risk management frameworks.

In addition, although European banks are increasingly offering green and sustainable loans as part of their product offering, the ECB’s Supervisory Review and Evaluation Process (SREP) has shown that many banks have yet to fully incorporate climate risks into their strategies and operations, with weaknesses noted in ESG-related planning and training. The lack of a robust transition pathway aligned with the Paris Agreement is also a concern, as banks that fail to act risk holding stranded assets.

As ESG risks become more prominent, banks can no longer ignore the importance of having a Chief Sustainability Officer (CSO) who would oversee ESG matters, promote green investments, and guide the bank toward sustainable practices.

The broader push towards ESG should be viewed as an opportunity. Indeed, investors and the public alike increasingly scrutinise banks that finance ‘brown’ assets, while younger generations, especially in Europe, consider a firm’s climate impact when job hunting.

While climate risks faced by Luxembourg’s banks might seem manageable in the short term, the long-term transition risks are significant, particularly as climate-related events increase in frequency and severity.

Our recommendations- The CEO should lead the creation or refinement of net-zero transition plans, ensuring these plans reflect both market and operational risks. Moreover, the CEO should ensure the plan’s alignment with the Paris Agreement, as well as oversee the bank’s disclosures on climate-related risks. Such efforts should be coordinated across departments, and the CEO shouldn’t hesitate to delegate responsibilities, especially to the CSO when such a position exists, while maintaining oversight.

- The CRO and the CCO should identify the full range of climate-related risks and explain how these affect the bank’s long-term strategy. They should also make sure the bank complies with sustainable finance regulations and develop climate risk policies.

- It is critical to implement the transition plan properly, and assigning clear responsibilities is essential to avoid gaps. The CSO should play a leading role in identifying ESG opportunities, collaborating with the CRO and the CCO, and communicating these to senior management and the board to shape the long-term strategy.

- A newly established CSO may not necessarily have banking experience, which is why an onboarding process is critical to familiarise them with the bank’s operations and sustainability goals. The CSO should also keep the CEO and the board updated on the bank’s progress and on any challenges in meeting sustainability targets.

ECB priority 3: Progress in the Digital Transformation and Digital Operational Resilience

Digitalising operations to meet customer expectations, reduce costs, and enhance efficiency has become a necessity for banks, and failing to adapt could lead to losing clients and market share to digital-first competitors.

Simultaneously, increased regulatory focus, through directives such as the Network and Information Systems Directive (NIS2) and the Digital Operational Resilience Act (DORA), are emphasising banks’ digital operational resilience, and the ECB itself is prioritising both banks’ digital transformation and operational resilience. Luxembourg’s banks should align with these priorities, not only to enhance competitiveness but also to seize new opportunities brought about by the digital transformation.

Well-crafted digital transformation strategies

The ECB expects banks to develop digital transformation plans aligned with their business strategy and risk management frameworks to strengthen sustainability and mitigate risks. However, in 2023, the ECB raised concerns about banks’ strategic execution and financial planning for the digital transformation, emphasising the need for upskilling and budgeting.

To remain competitive amid industry cost pressures and constant innovation, banks should invest in modernising services and embracing digital innovations such as cloud technology and Artificial Intelligence (AI). While many banks now offer mobile and online services, they need to focus on improving customer experience across digital and physical channels, developing end-to-end digital-ready products, and pursuing new revenue streams.

Luxembourg’s banking sector has made progress in digital transformation, adopting advanced technologies to enhance operations and customer services. However, much work remains to be done when it comes to accelerating investments in the digital transformation, especially given incentives such as the recently-introduced digital and ecological transformation (DET) 18% tax credit. Considering that the ECB is planning to carry out targeted reviews of banks’ digital transformation, Luxembourg’s banks—even those not directly supervised by the ECB—should continue investing in digital strategies and ensuring organisation-wide coordination.

Ultimately, the key to successful digital transformation lies in setting clear objectives, having robust measurement and governance structures, and aligning efforts with risk management frameworks.

Our recommendations- The digital transformation requires all stakeholders across the C-Suite to be aligned, with a clear governance structure to oversee the transformation led by the CEO and Chief Commercial Officer (CCO). The CEO should set general objectives ensuring alignment with the bank’s strategic goals and risk appetite.

- As the COO manages operational processes, they should adapt back-office functions to support digitisation, avoiding inefficiencies or missed objectives. The CIO or Chief Digital Officer (CDO) is central to the digital strategy, coordinating digital efforts with input from all executives. The CFO should ensure that initiatives are financially viable, budgeted, and aligned with the financial strategy, while the CRO integrates the digital strategy into the bank’s risk appetite.

- Setting relevant KPIs and performance metrics is crucial, and these should be regularly reviewed by the executive committee and the board to adapt to changing circumstances and lessons learnt.

- The CIO, alongside the CRO and the Chief Information Security Officer (CISO), should ensure the digital transformation undergoes rigorous risk assessments covering cyber-related risks.

- Risk management should be embedded in the strategy’s design and execution, with effective mechanisms for cyber-risk monitoring and reporting. The sooner the risks are identified and mitigated, the more successful the transformation will be.

- Senior management should proactively engage with regulatory bodies such as the CSSF and the ECB to align with expectations and ensure compliance with regulations.

Ensuring digital operational resilience

Ensuring digital operational resilience is becoming increasingly critical for European banks due to the rapidly evolving digital landscape, combined with heightened geopolitical tensions.

The ECB’s latest SREP identified deficiencies in how Euro Area banks manage ICT outsourcing and ICT security risks, which leads to heightened operational risks. The Digital Operational Resilience Act (DORA), effective from 17 January 2025, precisely aims to revolutionise how banks approach digital operational resilience.

As highlighted in our “DORA: What Matters Now for Your Business Resilience” report, a multi-disciplinary approach is essential for DORA’s successful implementation. It requires the active involvement of CEOs, CROs, COOs, CISOs, and CIOs. It also requires viewing DORA as being more than just an ICT compliance matter. In fact, it offers banks a chance to overhaul their digital resilience frameworks and prepare for upcoming regulations like the recently published EU Artificial Intelligence Act.

The ECB has made outsourcing arrangements and cyber resilience key supervisory priorities, and it plans to conduct a system-wide cyber resilience stress test to assess banks’ response capabilities to cybersecurity incidents, as well as their ability to restore services quickly. In addition to strengthening cybersecurity fundamentals, it is crucial for banks to develop emergency response plans, given the increasing sophistication of cyber threats, such as those using generative AI.

Considering the Grand Duchy’s position as a key international financial hub, Luxembourg banks need to keep vigilant and be prepared to face these challenges.

Our recommendations- The CISO is particularly critical in ensuring the bank’s digital operational resilience in line with the ECB’s expectations, as they play multiple roles (strategy, coordination, oversight, control and reporting).

- The C-Suite needs to collaborate closely during an emergency response. The CIO should ensure that necessary ICT assets are available, while the COO and the communications department effectively communicate the cyber incident to internal stakeholders, clients, and regulatory authorities.

- The CEO needs to oversee the entire recovery process to ensure it is carried out efficiently and on time.

- The regulation stresses the importance of transparency and oversight in the outsourcing chain, with the CRO and CCO taking the lead in assessing the reliability of ICT third-party providers. They need to ensure that the outsourcing register, which includes all ICT service agreements, is up-to-date and aligned with broader outsourcing risk management efforts.

Tax resilience and innovation

Although tax matters aren’t part of the ECB’s supervisory focus, Luxembourg’s banks must consider them when assessing risks and opportunities. The Grand Duchy initially faced challenges with the automatic exchange of information (AEoI) in the early 2010s, and in 2013, it was deemed non-compliant with the Organisation for Economic Co-operation and Development (OECD)’s standards.

However, by late 2015, the country had adopted the AEoI directive and affirmed its commitment to the OECD’s rules. In 2022, it wasn’t only fully compliant, but also fared well in a peer review evaluation. Despite these improvements, Luxembourgish banks are set to face more tax-related challenges, particularly with the implementation of the Central Electronic System of Payment Information (CESOP) in early 2024.

Banks now play an important role in identifying and reporting potential tax fraud, making them key actors in tax compliance.

Unlike previous tax regulations like the Foreign Account Tax Compliance Act (FATCA) or the Common Reporting Standard (CRS), CESOP focuses on payment data rather than client revenues. Given the enormous volume of transactions, banks must handle large datasets efficiently for a compliant quarterly reporting.

What’s more, CESOP’s requirements span across tax, ICT, and payments, which makes assigning responsibility for its implementation challenging.

Moreover, the global tax environment has also shifted towards greater transparency in recent years, and some European banks have begun voluntarily publishing tax transparency reports, which detail their tax strategies, governance, and contributions across countries. These reports go beyond legal requirements, demonstrating a commitment to responsible tax practices and fostering trust with stakeholders, including the public, investors, employees, and regulators.

Yet, despite increasing compliance demands, Luxembourg’s tax environment offers opportunities, too. The recently-introduced tax credit for investments in digital and ecological transformation (DET) is one such example, as it provides up to an 18% credit for investments related to the digital and ecological transformation. Considering the country’s stable tax landscape, banks are well-positioned to benefit from such tax incentives and to make the best of other tax-related matters to drive their growth.

Our recommendations- CEOs and CFOs should evaluate whether establishing a tax department or outsourcing tax functions is more beneficial. In addition, CEOs should take the lead in exploring how investment tax credit can support the bank’s operations, particularly when it comes to investments related to AI and the digital transformation (DET tax credit).

- CESOP’s fluid nature makes it difficult for banks to assign clear responsibilities. Some argue that the CIO should oversee CESOP’s implementation, while others believe it falls under the Head of Tax Affairs. Ultimately, responsibility should be shared between the CFO, CIO, and Head of Tax Affairs to ensure proper ICT processes and data reporting to tax authorities.

- For banks with strong ESG credentials, publishing an annual tax transparency report would be an endeavour worth considering. The CEO, CFO, CSO, and Head of Tax Affairs should collaborate to structure the report according to global standards such as GRI 207, ensuring the bank maintains a leading position in tax transparency.

Coping with heightened Financial Crime risks

The EU’s regulatory framework to combat financial crime (hereinafter, Anti-Money Laundering/AML) will soon be strengthened through the introduction of an EU-wide AML regulation and the establishment of a new AML Authority (AMLA). Similar to the ECB, AMLA will directly supervise specific financial entities in the EU based on their AML risk exposure and provide guidelines for national authorities to enhance oversight.

Despite these efforts, AML issues persist due to inadequate implementation and enforcement of existing regulations, especially in areas like Know Your Customer (KYC) and transaction monitoring. Recent AML failures in Baltic states highlighted the fragmented nature of AML enforcement across Europe.

In Luxembourg, a recent Financial Action Task Force (FATF) evaluation of the country’s AML framework was positive, praising the CSSF’s risk-based supervisory approach. While areas for improvement were noted in the non-financial sector, the financial sector’s AML policies were deemed solid. Nonetheless, Luxembourg’s banks would do well to get ready for the upcoming EU-wide AML changes and to make sure that they have the necessary resources at head.

Our recommendations- Responsibility for AML compliance ultimately rests with the CEO and the board of directors, as AML failures can lead to severe penalties and reputational damage. The CEO must regularly consult with the CCO, the CRO, the COO, and the CIO to ensure the bank’s AML processes are effective. It is critical that the board promotes a strong culture of AML compliance, setting the tone for the entire institution.

- CCOs and CROs should closely monitor the European Commission’s AML Package and ensure their bank’s AML policies are up-to-date and effective. The emphasis should be on making sure that AML frameworks, particularly in transaction monitoring, operate effectively and don’t only exist on paper. With many banks struggling to attract and retain AML staff, the COO plays a crucial role in addressing AML-related operational deficiencies and ensuring regulatory compliance.

- When it comes to incorporating AI solutions to the bank’s AML processes, the bank needs to bear in mind that while GenAI can complement AML efforts, human expertise will remain crucial. The CCO, the CRO, and the CIO must collaborate to prioritise processes, implement solutions, and address skill gaps among the staff, and the CRO should ensure governance frameworks are in place for AI oversight.

Leonard’s conclusion: Luxembourg’s path to strengthened resilience

Leonard closes the booklet and leans back on his chair, reflecting on the vast array of information he just gathered from this PwC Luxembourg report.

In general, Luxembourg’s banking sector has aligned well with the ECB’s supervisory priorities. Banks have demonstrated their resilience and compliance with regulation. However, they should keep vigilant and continue to prioritise key issues, such as their transformation strategy and the increasing importance of their role in ESG transition.

Nonetheless, despite these challenges, the tradition of effective and proactive governance that has characterised Luxembourg’s banking sector since the first banks were established in the mid-19th century puts it on a strong footing when it comes to addressing ECB-identified deficiencies. By doing so, the Grand Duchy can enhance its role as a leading European financial centre while maintaining stakeholder confidence amidst geopolitical and economic uncertainties.

“All right,” says Leonard aloud, opening a new text file on his laptop, confident he now has all the information he needs for that presentation. “Let’s do this!”

What we think

Earlier this year, geopolitical tensions combined with the rapid rise in interest rates sparked some volatility in global financial markets, raising concerns within the banking industry. While Europe’s banking sector remained resilient, Luxembourg’s banking leaders must now focus on future challenges. Aligning with the ECB’s broad supervisory priorities—from addressing cybersecurity and climate-related risks, to ensuring strong governance models and effective digital transformation strategies—will be crucial to maintaining stability and ensuring the sector’s resilience in an increasingly uncertain world.