Much like a top contending team in the European Championship, Luxembourg’s corporate banking sector excels by consistently strategising and optimising its operations. But to understand its prominence, we need to look back at its history.

Its rise began in the late 1960s when German banks entered the pan-European markets, capitalising on Luxembourg’s favourable regulatory landscape and establishing it as a global banking hub. Think of it as a football team securing a home advantage. And in light of the upcoming UEFA Euro Cup, we at the blog thought that football would make a timely metaphor.

Later on, the creation of the Eurodollar and Eurobond markets attracted Scandinavian, Swiss, and US banks, further expanding the sector—much like recruiting top international talent for a championship-winning team.

The 1990s were pivotal for the sector with the second EU banking directive, which enabled cross-border operations and solidified Luxembourg’s international position. More recently, Brexit further boosted the sector as UK institutions set up EU branches in Luxembourg.

Over the years, Luxembourg banks have evolved through regulatory changes, market developments, and strategic foresight to maintain their edge in the highly competitive corporate banking landscape—just as football teams need to continuously adapt to new opportunities and challenges to succeed.

Don’t have time to read the whole blog entry? Then watch our “Blog in 1 minute” video for a quick summary of its main points:

Our Corporate Banking Survey, which offers an insightful look into the current state and future trends of corporate banking, is an essential tool for Luxembourg’s corporate banks to maintain competitiveness. It provides key data and analysis that help them in decision making and strategic planning—the same way football managers rely on detailed analyses to craft their game plans for the European Championship.

In this blog, we share the 2023 season stats for Luxembourg’s corporate banking sector, based on the results from our survey, with a focus on operational efficiency and lending strategies.

The current corporate banking landscape in Luxembourg

Luxembourg’s corporate banking sector is a dynamic and integral part of its financial ecosystem, characterised by a robust focus on both domestic and international markets. Approximately 75% of Luxembourg’s corporate banking services are directed abroad, underscoring Luxembourg’s strategic positioning as a key player.

In the international arena, like a top-tier football team, Luxembourg banks meticulously plan and adapt their strategies, analysing global markets and regulatory environments to ensure they can tackle challenges and seize opportunities on a global scale and to tailor their services for international clients.

This strategic approach allows them to offer a diverse range of services, from cross-border lending and trade finance to sophisticated corporate wealth management and investment banking solutions.

At the same time, these banks maintain a strong focus on their domestic market, much like a football team builds a robust support base at home. They provide essential banking services to local small and medium-sized enterprises (SMEs) and the resident population, ensuring that their foundational strengths are solid.

This dual focus is crucial for their overall strategy, enabling them to remain competitive and agile.

1. Corporate banking’s financial performance

Corporate banking’s financial performance can be viewed like a football season with victories and setbacks: In 2022, Luxembourg’s corporate banks achieved record revenues of nearly EUR 5bn, a 24% increase from the previous year. However, profits fell by 19% to EUR 1.2bn due to high operating costs, tight credit supply, among other challenges.

These challenges highlight the delicate balance Luxembourg’s corporate banks need to maintain to achieve sustained success, just as a football team needs to navigate a demanding season with both triumphs and trials. To keep the scales tilted towards success, they are opting to diversify.

2. Diversification and revenue growth

Luxembourg’s corporate banks have been actively pursuing growth in non-interest-based services, demonstrating a strategic shift to diversify their income streams. This path, which has led to a notable 14% increase in revenues from the funds sector, not only enhances their financial performance, but also positions them favourably to withstand market fluctuations and economic uncertainties—much like a football team that thrives by being versatile and adaptable in its gameplay.

They are particularly focusing on Asset and Wealth Management (AWM), a sector with significant growth potential that has provided them with robust opportunities to enhance revenue. We can compare this move to a football team recognising the strengths of its players and adjusting its strategy to maximise their potential on the field. Whether it’s leveraging star strikers for scoring or shoring up defence, the team adapts to different scenarios to secure victories.

Speaking of strengths and strategy, the first edition of our survey showed that corporate lending was one of the areas that the corporate banking sector was looking to expand in the future. As such, we decided to focus on it for the 2023 edition and our blog.

Introducing corporate lending

Corporate lending is a crucial aspect of Luxembourg’s banking sector, providing essential financial support to companies rather than individuals. This type of lending is vital for funding business operations, expansion projects, and other significant corporate activities, underscoring its importance in the economic landscape.

There are two primary types of corporate lending in Luxembourg: national lending focuses on domestic companies, providing them with the capital needed to thrive within Luxembourg. In contrast, international lending extends beyond the country’s borders, supporting global enterprises and facilitating cross-border financial activities.

Luxembourg’s strategic location and robust financial infrastructure make it an ideal hub for both national and international corporate lending. You can picture the Grand Duchy as a central stadium that hosts both local league matches and international tournaments. But as with any good host, you need to understand and follow the protocol.

Corporate lending in practice

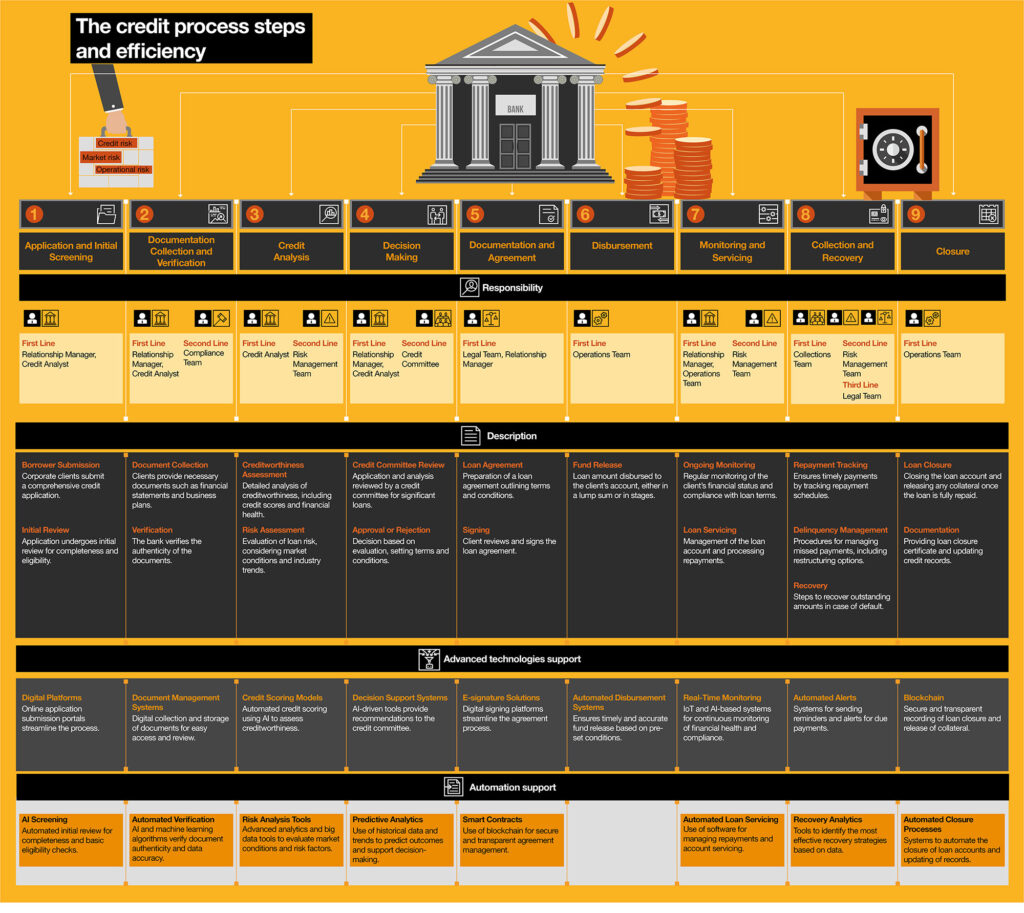

We can compare the corporate lending process to a well-coordinated football play, where each stage is meticulously planned and executed to achieve the desired outcome. It begins with origination, where financial experts identify potential lending opportunities and solutions to meet corporate financing needs.

This is followed by the execution phase, involving rigorous underwriting and approval processes. Just as a football team carefully scouts and signs new players, ensuring they fit into the team’s strategy, banks meticulously evaluate potential borrowers to build a strong loan portfolio. Once approved, the process moves to documentation and disbursement. This is where the loan agreement is formalised and the funds released.

Throughout the loan’s lifecycle, risk management is paramount, akin to a football team’s defensive strategy, ensuring the portfolio remains protected from market volatility and other risks. Additionally, collections, recovery and portfolio management teams work continuously to maintain regulatory compliance and manage the loan’s performance, much like a football team’s efforts to maintain peak performance and adhere to the game rules.

Luxembourg banks often specialise as booking centres for international loans within their banking groups. This means they record loans originated by their parent or affiliated institutions in other countries, typically with some form of guarantees, and oversee the loans throughout their lifespan. This model is especially prevalent among Luxembourg branches or subsidiaries of large international banking groups.

Furthermore, some Luxembourg banks engage in agency business, managing the complexities of syndicated loans and multi-party transactions. In this role, they coordinate between borrowers and lenders, acting as facility, information and paying agents.

This multifaceted responsibility requires meticulous covenant monitoring and collateral management, ensuring the integrity of loan agreements, similar to a football team’s playmaker orchestrating moves and ensuring team coordination.

Following the process painstakingly and in a coordinated manner is essential for banks to deliver exceptional customer service. There are, however, two other elements that can be a transformative force in the corporate lending sector: Technology and operational efficiency. They go hand in hand.

Technological advancements and operational efficiency

Football teams increasingly rely on the latest sports science and technology, such as data analytics and artificial intelligence (AI), to refine their tactics and optimise performance. Similarly, Luxembourg banks are using technology more and more to stay ahead of the competition.

Technological advancements are also helping banks to enhance their operational efficiency, which is crucial in the lending sector as it can significantly impact banks’ ability to provide timely and effective financial solutions to their clients.

One of the most notable technological advancements is the introduction of generative AI (GenAI) solutions for credit analysis. These tools offer a range of benefits, including faster and more accurate credit assessments, which reduce the need for labour-intensive processes.

Digitalisation and automation have also emerged as key strategies for achieving operational efficiency. According to our survey, 33% of respondents prioritise digitalisation and the streamlining of processes through automation. These results are unsurprising. By automating complex tasks, banks can allocate resources more effectively, enhancing productivity and service delivery.

These strategies also enable banks to handle larger volumes of transactions with greater speed and precision, and to better understand market trends, predict client needs, and optimise their operational workflows.

In addition to digitalisation and automation, banks are employing other strategies, including outsourcing certain functions (17%) and embedding AI within various operational processes (11%). The former allows banks to focus on their core competencies while external experts handle specialised tasks, similar to a football team hiring top-notch analysts to provide insights and support, while embedding AI further enhances decision-making capabilities.

Besides integrating these strategies, Luxembourg’s corporate banks need to also consider how sustainability is transforming the corporate lending sector and to adapt accordingly.

Sustainability and industry transformation

Sustainability and industry transformation are becoming increasingly vital in the corporate lending sector, with ESG (Environmental, Social, and Governance) financing playing a crucial role. ESG financing is transforming corporate lending by encouraging banks to consider not only financial returns, but also the broader impact of their investments on society and the environment.

Indeed, banks are increasingly recognising the need to align their operations with ESG principles, ensuring that their financial activities support environmental protection, social equity and good governance, thus positioning them as responsible stewards of economic and environmental wellbeing.

This shift not only addresses regulatory and market demands, but also reflects a growing awareness of the long-term benefits of sustainable finance. Back to our analogy, we can compare it to a football team not only aiming to win matches, but also striving to be ambassadors of fair play, community engagement, and environmental responsibility.

AI and other advanced technologies are pivotal in driving this change. They enable banks to assess ESG criteria more effectively, manage risks associated with sustainable investments, and identify new opportunities for green financing. AI in particular facilitates better decision-making and more efficient operations in line with sustainability goals.

Final words

The PwC Corporate Banking Survey 2023 highlights Luxembourg’s banking sector’s focus on international markets, the impressive growth in non-interest-based services, and the technological advancements’ critical role in enhancing operational efficiency. It also underscores the importance of ESG financing in transforming corporate lending and preparing for future challenges.

Reflecting on the sector’s dynamic nature, it’s clear that its ability to adapt and innovate is essential for its success. Like a top-tier football team that continuously evolves to stay competitive, the sector has demonstrated resilience and strategic foresight. Moreover, Luxembourg banks have shown they can balance the dual demands of global ambition and local responsibility, ensuring robust performance on both fronts.

Looking ahead, the sector faces a mix of opportunities and challenges. Embracing new technologies and sustainable practices will be crucial for maintaining a competitive edge. The importance of thinking globally and acting locally can’t be overstated; it’s this balance that will enable Luxembourg’s banks to navigate the complexities of the international financial landscape while supporting domestic growth.

To conclude, Luxembourg banks’ strategic planning, efficient execution and adaptability to new rules, technologies, and market conditions have ensured and will continue to ensure future success in the corporate banking championship.

What we think

In the rapidly evolving landscape of corporate banking, Luxembourg stands out as a strategic player by continuously innovating and adapting to global changes. Our banking sector’s success hinges on its ability to blend technological advancements, regulatory foresight, and a commitment to sustainability, much like a top-tier football team perfecting its game plan to stay ahead in the championship.

Jörg Ackermann, Partner at PwC Luxembourg

Operational efficiency and strategic agility are the hallmarks of Luxembourg’s corporate banking sector. By capitalising on digitalisation and embracing ESG principles, our banks are not only enhancing their competitive edge but also paving the way for a more resilient and sustainable financial future. It’s this forward-thinking approach that keeps Luxembourg at the forefront of the global banking arena.

Daniel Theobald, Director at PwC Luxembourg