The insurance industry is in a unique place right now, something akin to the calm before the storm. There are multiple changes, especially when it comes to technology and innovation that are about to rock the boat and bring serious changes. To discuss them, we’re having our first guest blog, written by Carlos Montalvo Rebuelta, former top European regulator and Executive Director at European Insurance and Occupational Pensions Authority (EIPOA).

Trust is the cornerstone of insurance

Insurance will continue to fulfil its promises and trust is still going to be the cornerstone of the industry.

Like other sectors, insurance faces broader challenges, particularly changing customer behaviour. Customers are increasingly demanding simplicity, transparency and speed in their transactions with insurance agents/advisers. The relentless march of online and mobile technology is continuing to fuel this change in customer expectations.

Customers’ behaviour to affect insurance

Insurance will increasingly be ‘bought’ by customers as opposed to being ‘sold’ by agents. Let’s keep in mind that insurance is sold and not bought. This shift will force insurers and agents to re-examine their roles in the insurance value chain to become more relevant to the end-customer. Customers will not be willing to pay, unless they receive value.

In the meantime, customer expectations of transparency will foster innovation in product/service design and delivery. Leading insurers will get better at targeting customers as well as customising product and service attributes to meet their specific needs, amassing greater customer surplus.

Mobility and speed of service demanded by customers will translate into investments in mobile and interactive technologies for multimedia content creation and distribution, as well as transactional capabilities across multiple digital platforms.

Insurers need to build more systemic interactions with customers, particularly tapping into digital channels.

Technology to help insurance players

New technologies are significantly enhancing operational efficiencies, increasing revenue opportunities and improving the customer experience. Using unstructured data (e.g. social media, devices, video and audio) will complement structured data, allowing insurers to make strategic forward-looking decisions.

Commercial insurers are already using connected devices and sensors to develop risk and loss management and improve productivity. Life and health insurers should also use them.

“Insurtech” to disrupt insurance

Insurtech has gained substance over the last months. There is good reason to believe that insurance is indeed heading down the path of disruptive innovation. Against all odds, some insurers are not willing to invest in innovation.

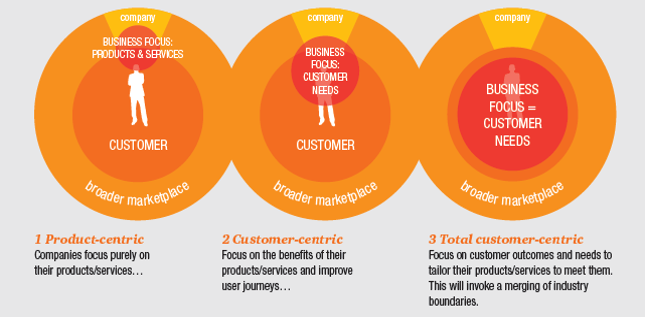

Incumbent insurers are currently too focused on catching up with their competitors around customer centricity and other current trends. So they are missing the opportunity to become proactive. They need to create a clear and consistent message that will show how willing they are to play in the new Insurtech space. Only such an approach will position incumbents to be front-runners in the new insurance era.

Regulation still high on insurers’ agenda

The industry is in the eye of the storm of new and more specific regulatory demands. On top of prudential regulation, insurers also had to comply with conduct regulation, embodied by the Insurance Distribution Directive (IDD).

The IDD reflects the relentless regulatory journey toward greater consumer protection, accountability and transparency in financial services. Some of the provisions on product and remuneration disclosures, professional qualification requirements and suitability assessments reflect elements of PRIIPs, RDR and MiFID/MiFID II. Yet there are differences between these regulatory regimes, which coupled with the new governance regimes under SIMR and the Senior Managers Regime, create a patchwork of regulation that may result in a mismatch of requirements for firms, particularly financial conglomerates.

The IDD introduces two overriding principles that are going to change their modus operandi:

- Distributors must always act honestly, fairly and professionally in accordance with the best interest of customers;

- Information provided by distributors to customers or potential customers should be fair, clear and not misleading.

While the IDD entered into force in 2016 – to be transposed into national law by 24 February 2018 – the industry hasn’t taken action.

To know more about how Insurtech is reshaping insurance, check out this survey.