The Beatles said, quite beautifully and simply, “All you need is love”. But we all know that, as much as we wish it were true, that it’s not quite accurate. Relationships are complex, multidimensional and dependent on many variables. There are so many types of love: affectionate love, familiar love, romantic love, self love. And even within these categories, we find that no relationship is the same.

Great thinkers, artists, scientists, have all tried to crack the code when it comes to love, trying to identify the secret recipe for a long-lasting, robust and healthy relationship. When thinking of such a relationship, we are reminded of the resilient love affair between Luxembourg and the global cross-border distribution market.

While we could examine the success factors behind this relationship, which keeps maturing, we believe we are past that. Instead, in this blog, we share the highlights from the 23rd edition of the annual Global Fund Distribution (GFD) poster, which presents the evolution of cross-border funds and distribution in 2022. The poster has become a reference tool for asset managers requiring an overview of the global cross-border fund market.

Don’t have time to read the whole blog entry? Then watch our “Blog in 1 minute” video for a quick summary of its main points:

This year’s edition showcases once more Luxembourg’s leading position and the resilience of the cross-border fund distribution space in light of significant macroeconomic volatility.

No news is good news for Luxembourg

We know you would like to hear some spicy gossip about Luxembourg’s relationship with the fund industry, but, alas, we are going to disappoint you. The truth is that this love affair, unlike a Brazilian or Mexican telenovela, which taught us to expect plenty of twists and turns, remains rock solid—Luxembourg didn’t merit the title of ‘the Gibraltar of the North’ for no reason.

Indeed, Luxembourg’s dominance and the market share it has garnered and continues to maintain in the cross-border fund market is extremely impressive, and testament to the continuing goals of the country, and the close working relationships between the regulator, the government and the businesses as a whole.

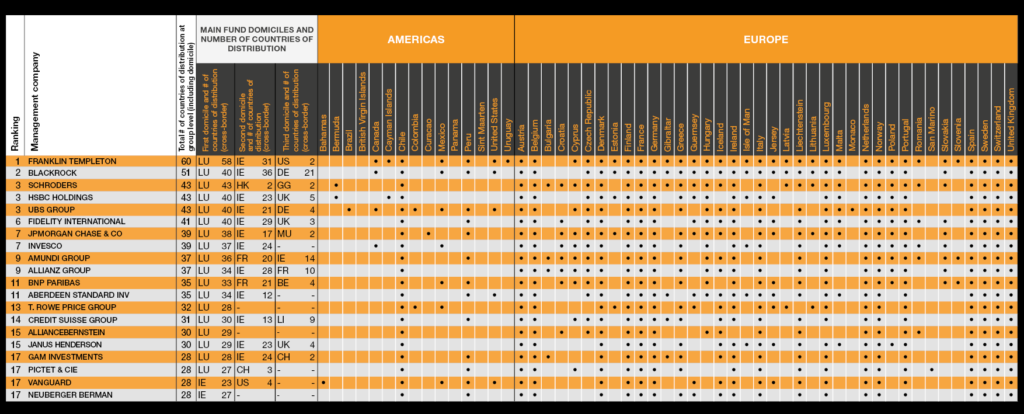

The top 20 cross-border asset management companies

The top five asset management companies for cross-border distribution funds worldwide, ranked according to the number of countries in which they are marketed, are Franklin Templeton, BlackRock, Schroders, HSBC Holdings and UBS Group.

Franklin Templeton is once again the leading asset manager with their cross-border funds distributed in nine more countries than BlackRock, ranked in second place. For all five companies, Luxembourg is the first-choice country of domicile of their cross-border funds.

In fact, looking more deeply into the numbers, we can see that 18 out of the top 20 asset management companies have chosen Luxembourg as their first-choice country of domicile; another example of the global recognition of Luxembourg.

Cross-border investment funds globally

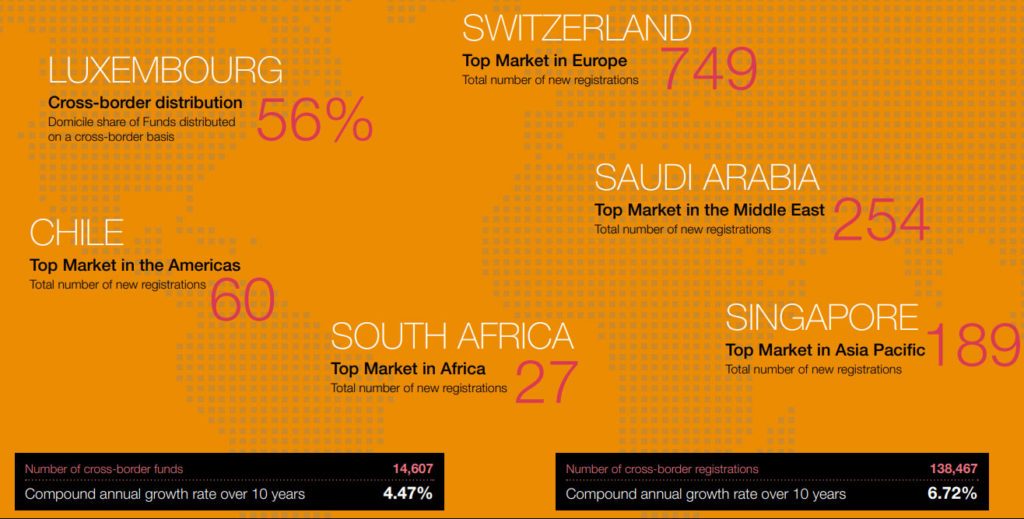

Despite significant macroeconomic volatility in 2022, reflected in meaningful decreases in both UCITS net fund sales and UCITS AuM, cross-border investment fund registrations continued to increase.

A total of 14,607 cross-border investment funds accounted for 138,467 registrations globally as of end-2022. This represents a 2.9% growth in the number of cross-border funds and a 4.3% rise in registrations compared to the prior year.

When it comes to asset classes, equity funds take the lead, boasting 7,301 funds, which accounted for 50% of the global cross-border fund market. Bond funds followed with 3,972 cross-border funds, making up 27% of the market. Multi-asset funds represented 10% of the market, while liquid alternatives and Money Market Funds (MMF) held 11% and 2% respectively.

Hence, whilst we see that the market conditions, investor confidence and a high number of redemptions might have had a negative impact on net sales, there’s still growth, new funds, new territories and new asset managers joining the cross-border distribution space.

The regulatory tsunami returns

Some years ago, the fund industry talked about the regulatory tsunami, but eventually we got used to riding these waves and the seas calmed. For Robert Glover, Partner, Global Fund Distribution at PwC Luxembourg, those waves have been increasing again over the past couple of years.

There’s a continued push with new requirements, enhancements and greater transparency on reporting, as well as new regulations frequently coming into play: whether it’s ESG or SFDR related, the changes in some of the regulations that govern the cross-border distribution framework, such as AIFMD II, increased scrutiny from regulators on marketing activities or the enhanced powers that the European Commission is looking to pass on to the European Securities and Markets Authority (ESMA), the list is endless. Yet, this doesn’t seem to be putting players off.

That being said, there is a downside for the industry: it’s costly for asset managers to comply with all the regulations. Simultaneously, they are now being closely monitored by the regulatory authorities in terms of the fees and commissions that they themselves charge their underlying investors, putting them under pressure.

Which then further translates into fee pressure across the industry as a whole, as service providers throughout the value chain will be challenged on their fees. Add into the mix the recent inflationary impacts on the cost of doing business, and very quickly the view of the horizon is lost to the waves.

Regional breakdown

As indicated, whilst there may not be many ‘Dear Diary’ changes in this year’s poster compared to previous editions, there are still some noteworthy areas to highlight:

Europe

Switzerland recorded the largest increase in the number of new registrations in 2022, with 749 funds being registered, bringing the total number of registrations to 10,025. However, Germany remains the top country in Europe in terms of total number of cross-border fund registrations, with 11,693 cross-border funds registered for sale.

Asia Pacific

As per previous years, Singapore maintained its position as the top market in terms of new and total number of registrations in 2022, with 189 new registrations, bringing the total number of registrations to 4,502.

The country has been the top market for quite some time and that’s mainly because of the way the regime operates there, which is much less cumbersome than some of the other cross-border regimes within the Asia region, notably Hong Kong, which remains second in terms of popularity.

Middle East

Saudi Arabia replaces Israel as the top market in terms of new registrations in 2022, with 254 new registrations. The main driver of this is Exchange-traded funds (ETFs), as a couple of big players decided to register their products in Saudi Arabia.

Let us explain: when ETF players decide to register in a new country, they usually register all their funds, and, in fact, the very nature of this type of product means there is a high number of funds involved. In this particular case, it was BlackRock with over 240 funds being registered in 2022, that accounts for the position of Saudi Arabia. A slight skewing of the numbers to a certain extent.

As for the total number of registrations in the region, the UAE is still ranked first, with 370 funds.

Americas

Chile maintains its leading position within the Americas in terms of total number of registrations, with 1,813 funds registered for sale as of end 2022 and 60 new registrations. Sint Maarten and Curacao recorded the largest increases in fund registrations, each 56 new registrations.

Africa

In terms of the total number of funds registered for sale, South Africa continues to lead the continent, with 27 new registrations equalling to a total of 310 funds registered for sale.

Last words and a look into the future

To conclude, the latest GFD poster shows that, against the backdrop of the difficult financial outlook we find ourselves in, the crisis in Ukraine, the energy crisis, high inflation, and everything else we have mentioned above within the asset management industry, there’s still strong, steady growth within the cross-border distribution space.

When we asked Robert about what the future looks like for the industry, he highlighted two things. First, a greater level of consolidation, with certain big asset managers acquiring some of the smaller, more niche ones in terms of investment strategies, expanding their overall appeal over and above their typical approach.

Second, we are going to see a continued move into the alternative industry, and with the advent of the ELTIF 2.0, Luxembourg will be well placed.

Whilst no relationship can ever be certain, one cannot doubt the commitment of Luxembourg to the cross-border fund market. And whilst history alone is no guarantee of the future, it is clear that neither the regulator, the government or the asset management industry are resting on their laurels, and the drive to remain number one is as strong as ever.

The full 2023 edition of the GFD Poster is available here.

What we think

While the effects of a rapidly changing macroeconomic environment are particularly evident when we look at last year’s UCITS net sales and AuM, the overall distribution landscape continues to grow, with Luxembourg retaining a significant lead as the domicile of choice for asset managers engaged in the global expansion of their funds business.

Robert Glover, Partner, Global Fund Distribution, at PwC Luxembourg