According to our recent outsourcing study (we will come back to it later), 90% of Luxembourg’s financial centre outsources activities, confirming that outsourcing is more than just a hot topic, it’s a reality already well established in the financial sector’s organisation landscape. In addition, the market is increasingly looking to managed service providers who “go beyond the back office”.

Alternatives (Alts) players have been rethinking their operating models for some time, asking themselves the big question: Should we do this internally with an in-house team or rely on external service providers — or both?

In 2021, we wrote a blog entitled, “The back office evolution in the Alternatives industry,” which highlighted the transformation of the back office’s role. In a second blog in early 2023, “An even finer balance: Is the human resources shortage the game changer for the operating models in alternatives?”, we wrote about how co-sourcing options are becoming more appealing to close the human resources shortage gap, obtain fit-for-purpose technology and ensure compliance (by closing technical skills gaps).

In the current environment, Alts players are rethinking even more. And when considering their co-sourcing options, the cost element is no longer the only key criteria.

Don’t have time to read the whole blog entry? Then watch our “Blog in 1 minute” video for a quick summary of its main points:

Current trends: Macro headwinds and a changing world

One of the main causes for the rethink of operating models is the restraint of macro headwinds—economic developments that undermine prevailing price trends in financial markets.

Sticky inflation, high interest rates, and uncertain growth are defining the current economic situation we are in. This means that, “The global alternatives industry is set to grow at a lesser pace compared to recent years as macroeconomic factors were expected to weigh on fundraising and performance,” as a report by Preqin found.

This slowdown also has the effect of giving fund managers more time to rethink their operations (whereas before they were fully concentrated on deals and transactions due to heavy activity), with a goal to gain competitive edge and much-needed agility.

As mentioned, outsourcing is already deep-rooted in the financial sector’s organisational structure. In our recently published fourth edition of the ‘Sourcing Strategies Survey – The Age of Strategic Agility’, the extent of this was revealed: 90% of respondents outsource some kind of activity, and 88% when looking at just the Alternative Investment Fund Managers (AIFMs). What’s changing is the shape of the service provision, moving more to a single provider and favouring quality and expertise over cost while all the time expecting more in terms of service.

On top of those factors, geopolitical instability and trade disruptions are the new normal. And there are other forces at play.

Acceleration on the technology side makes it more difficult to make a fit-for-purpose tool, which is a must to remain competitive. New technologies—with a particular nod to Artificial Intelligence and the disruption it’s bringing—look set to redefine virtually every sector and industry

In this new context, financial institutions have no choice but to scrutinise their operational models, enhance their efficiency, and remain agile, all while navigating the intricate and perpetually evolving regulatory landscape.

Another challenge is the human resources shortage, which becomes more difficult to recruit and retain the right talents. This is a well-known issue in Luxembourg, but while it’s locally applicable, it’s also a worldwide phenomenon.

An age that demands strategic agility

As far back as 2019, a Preqin special report on service providers in Alternative assets was already reporting that 23% of the fund managers were planning to change their fund administrator.

Our specialists observe that this trend keeps on increasing as Alts players feel the current period seems to be good to launch Requests for Proposals (RfPs) to devise a new operating model or at least revamp the existing one. Another 56% of those who participated in the survey stated they weren’t fully satisfied with their current fund manager’s quality of service, again, suggesting a change is afoot.

Alternatives players need to be forward-thinking and agile enough for a shifting world, and this is one of the goals of a change of operations. But in doing so, what are the considerations of a co-sourcing or outsourcing solution?

Cost, of course, remains a parameter, but it isn’t the only one, and this is a significant evolution. In the past, in co- and outsourcing arrangements, cost was predominant. It was about finding the most cost-effective balance. Now, it isn’t enough. Financial players are looking for techno-enabled solutions, backed by highly-skilled professionals to deal with ever-increasing regulations. And they want no compromise on quality.

Also, what our specialists see is that some players who were used to performing certain activities in-house are starting to feel more pressure, and hence occasionally consider going for outsourcing models and even envisage lifting out of existing in-house teams.

There are hefty challenges to building up the necessary capabilities in-house – at the right pace at the right time – and then maintaining them over time. This usually requires continuous investment and time, not to mention expertise that may be peripheral to the fund manager’s.

Smooth transition is critical

When considering a new operating model, there can sometimes be a cultural resistance or fear to change or to “lose control” on operations. This is where a deeper managed services partnership concept comes into play.

As we explained in detail in an earlier referenced blog, “An even finer balance…,” there are a myriad of factors that drive the strategy to find the right profiles for the right place at the right time, now further compounded by a global economy facing significant challenges.

These factors increasingly put pressure on fund managers, management companies and service providers to understand and consider carefully the different types of operating models they can adopt.

Outsourcing isn’t what it used to be. In the past, fund managers were sometimes exposed to a number of service providers, performing more basic back-office tasks. But in the new normal, they need more.

They need deeper partnerships and trusted asset expertise. They also need to exploit real-time data and this can also drive the push for co-sourcing, which offers a hybrid model for a temporary, or eventually permanent, way for fund managers to work with their administrators. This means that the solution has expanded from being just about closing the capability gap to one that goes “beyond the back office” function.

According to an article published in strategy+business magazine, ‘Beyond the back office: How managed services partnerships drive outperformance,’ “new research shows how leading companies go beyond “old-school” notions of managed services to close talent gaps, keep pace with technology, and innovate for strategic advantage.”

Seven attributes of a good managed services partnership

1. The mindset needs to move from that of a vendor to a partner relationship.

Service providers should contribute and be proactive, acting as a “sounding board”, discussing, debriefing, offering a second opinion and trying to find the best solution through a process. Choosing a new service provider or fund administrator isn’t a simple decision, but choosing the right people with the right expertise who offer a full service that goes beyond the simple production of deliverables is.

2. Service delivery has to utilise a client-centric approach.

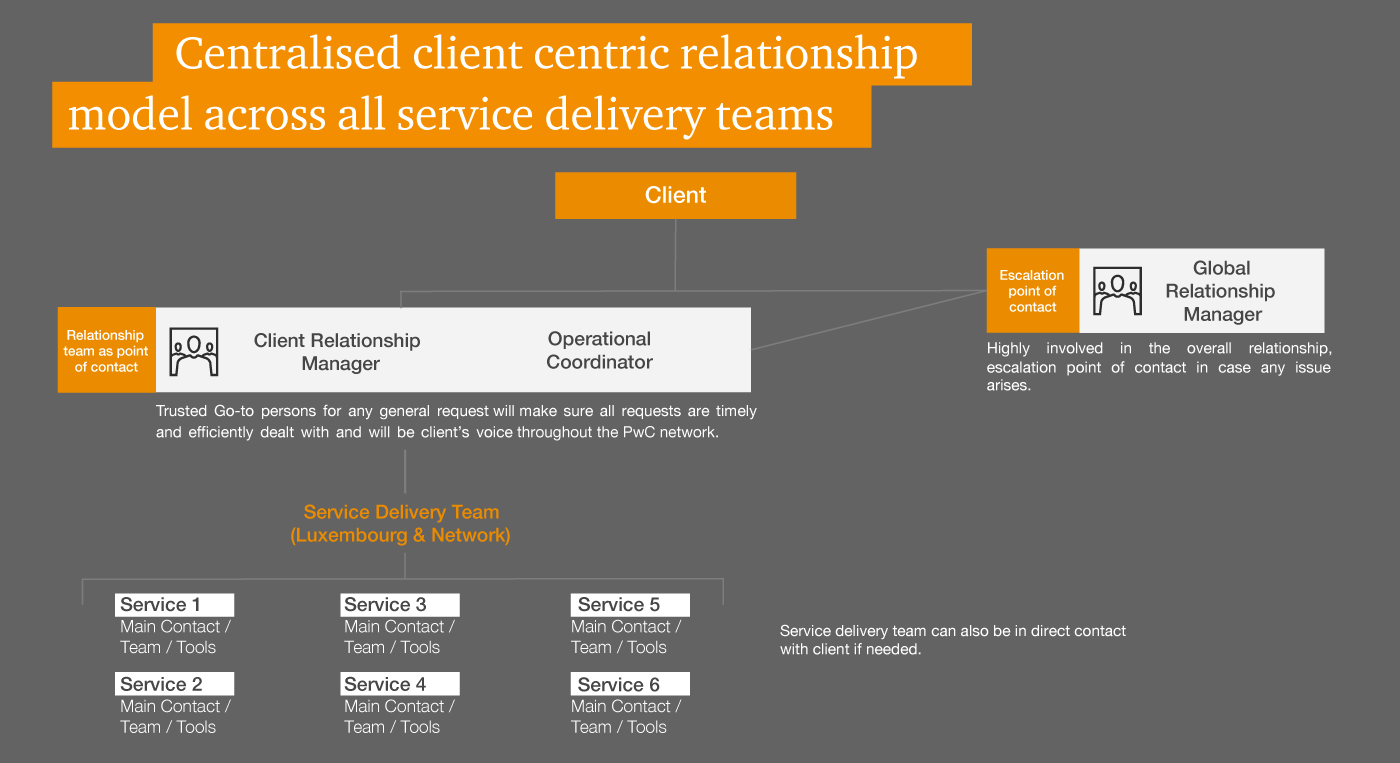

In December, our specialists published an article, “CRM: A collaborative approach to enhance service delivery”, which highlights in detail why PwC Luxembourg has rethought and slightly adapted its operating model to satisfy market players opting for the managed services approach.

This organisational model relies on an empowered Client Relationship Manager (CRM) to oversee the services and implement a joint and common approach to deliver the services.

3. Technology

The advent of new technologies and all related innovations are reshaping the way professionals operate. Technology that can drive changes with data is becoming the new gold. Being able to aggregate, sanitise and manage data efficiently, in a real-time manner, is a game changer.

Expectations on automation and efficiency gains, real-time reporting, and analytics while keeping pace with all the latest regulations, including around ESG and data security, are making the equations ever more complex.

4. A digital client experience

From the onboarding, data repository and management systems, workflow management to enhance processes, dashboarding with data analytics and real-time insights, the digital experience has to be seamless and scalable.

The ultimate objective is for the data to be accessible in only one click along with the provision of tailored, convenient, and seamless access to financial information and all relevant business insights.

Microsoft Excel is the world’s most widely used analytic tool, but it has shown its limitations in the boom era of data.The time has come for a major change from the spreadsheets, which are still massively used in the industry.

5. A one-stop-shop or a-la-carte partner

In our latest outsourcing study, we see the rise of single service providers, which has increased from 37% to 48% between 2021 and 2023.This is a sign of the general consolidation observed within the industry, with firms pivoting from partial to full outsourcing.

If in the past Alts players were used to dealing with multiple providers, now we are seeing a concentration. They are increasingly looking for a one-stop-shop for all their needs at all levels of their alternative structure, in all the countries where they invest, and at each step of the life cycle.

Such needs (or services) include Special Purpose Vehicle (SPV) Accounting services, Financial Statements Preparation, Fund Administration services, Corporate Secretarial services, Corporate Tax services, VAT Compliance, Transfer Pricing, Investor Tax Reporting, Investor Regulatory Reporting, Global Withholding Tax Reclaims, Automatic Exchange of Information and Mandatory Disclosure Rules (DAC 6).

At the same time, we also see clients who are looking for something even more tailored to their needs. They have an “à la carte” mindset, looking for a specific expertise or support because they have their own strong in-house teams to manage everything else internally. Therefore, they are looking for a strong collaboration with their teams so that the outsourced services act as a real team extension.

6. Building economies of scale and sharing best practices to provide a state of the art experience

Scalability is always important, but this is especially true during uncertain times, and this applies to both HR and technology. Best-in-class technological solutions that work and are concept proofed, and human resources solutions that provide the agility fund managers need in the new normal, make it easier for Alts players to adapt and scale their operations quickly, or as needed, but without straining their budget.

7. Make the back office right to expand to middle office

One of the big rethinks is about challenging the idea that managed services are best suited to back-office functions. Players in the Alternatives industry are looking beyond that traditional, functional-only model with a growing appetite for service provision for the middle office. This is especially true in the face of technological advances such as encroaching AI, where there exists a human resources gap for specific skills outside the fund managers’ expertise.

Companies are looking to transform. For many of these players the middle office isn’t their key priority, but they recognise it’s a necessary part of the business model. In such a case, there might be interest in a service provider for other activities connected to risk management support, trade settlement support or performance measurement, for instance.

Embracing the new era

The aforementioned Preqin study shows that many fund managers have been looking to change their fund administrators. We have also shown how external factors are pushing for a rethink of operation models to access talent and technology, with the goal of reducing costs, but also becoming faster, more agile and more innovative.

The strategy+business article, through its research, revealed that, “…top-performing companies are using service partners far more broadly and strategically than traditional definitions might imply. Whatever you call them though, these service partnerships offer access to expertise, knowledge, and technology assets that help accelerate enterprise transformation and performance around capabilities that companies view as critical—and sometimes even differentiating.”

It continues: “On their own, companies may struggle to build these capabilities at the required pace, and to keep them relevant over time. And even if they could do both, the effort might dilute their focus on the distinctive activities that matter most to their competitive advantage.”

Although not exclusive to the Alternatives Industry, the PwC survey research clearly demonstrated that there are many advantages when making the most of managed services partnerships and that this outperformance is the hallmark of the new era of managed services:

The conclusion? If you are a fund manager considering a change in operational model, the time may be right to consider a managed services solution in a more strategic and mature way. This offers you greater agility as a deeper partnership helps close talent gaps, keep pace with technology, and innovate for strategic advantage. Then you can focus on activities that deliver higher value, increasing your odds of arriving at the outcomes that matter—and improving your ability to sustain them.

What we think

The vast majority of Alternatives players outsource some kind of activity and the trend is growing. Going beyond the pure back-office function is key, and the expectation is more about having a real business partner bringing the right people with the right expertise and offering a tailored service (one-stop-shop or “A la carte”), which goes beyond the simple production of deliverables, with no compromise on quality.

Alexandre Igel, Client & Market Leader Managed Services for Alternative investments industry, PwC Luxembourg