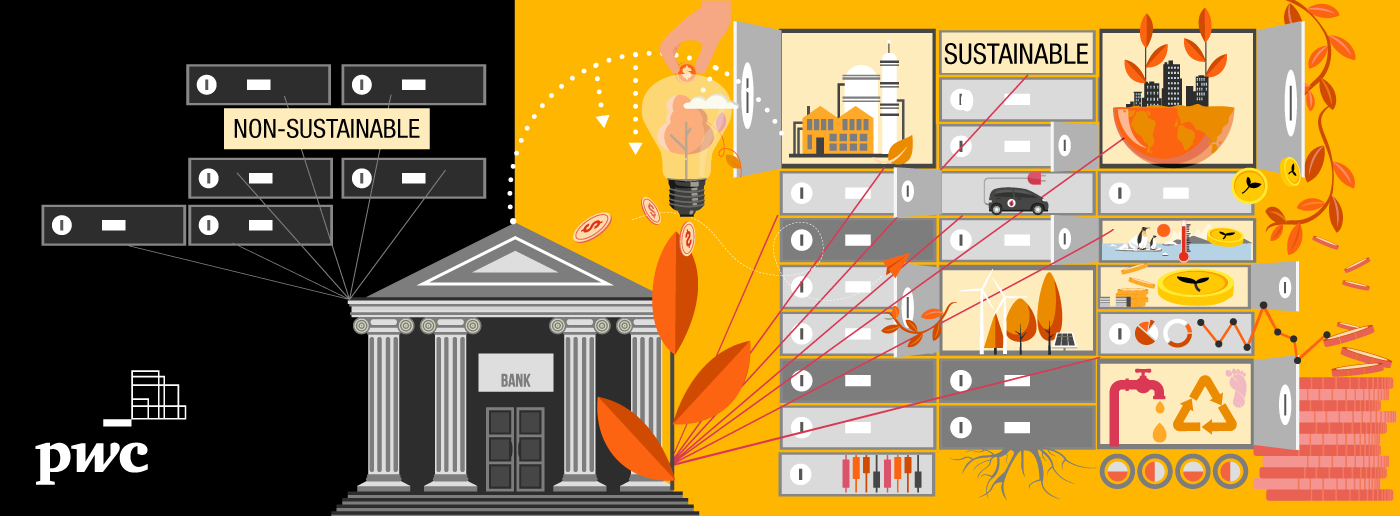

Can banks help save the world? Maybe, but they can’t do it alone.

Banks have a unique opportunity to become powerful agents of positive change via Environment, Social and Governance (ESG) principles and helping to finance the green transition. But how is this going to come about when saving the planet is no simple task (and when trying to remain prosperous while doing …